The 30% Club Ireland, whose aim is to achieve better gender balance at all levels in Irish businesses, has announced two new development opportunities for women in business – a 2023 programme of 27 postgraduate and executive education scholarships and, in partnership with AIB, 30 access opportunities for women in SMEs on the IMI/30% Club cross-company mentoring programme.

The scholarship programme, which is delivered in partnership with key education providers, covers a range of executive education disciplines including prestigious MBA programmes and technical masters programmes in STEM, Healthcare, Public Policy and other specialist areas.

First offered in 2015, the annual programme aims to raise participation rates for women in, and general awareness of, executive education and to provide financial support for women interested in executive education, who may be limited by funding concerns.

Gillian Harford, Country Executive with the 30% Club commented: “International Women’s Day takes place on March 8th. But it is about more than celebrating just one day, it is about taking real and practical steps that will help to bring about more balanced investment in talent and career progression.

“Having offered just three scholarships in year one, we are delighted now to be offering 27 scholarships for 2023”, said Ms Harford. “In addition to providing great opportunities for talented women, the programme gives us, and our education partners, the opportunity to encourage more diversity in executive classrooms for greater learning outcomes.”

The scholarship programme is open to all women and is not restricted to 30% Club member company supporters.

In partnership with AIB, the 30% Club has also announced a new 3-year initiative that will provide sponsored access for 30 women from the SME sector to the IMI/30% Club Cross Company Mentoring programme. The IMI/30% Club programme started in 2015 and brings together experienced leaders and mid-career high potential individuals for mentoring focused on both professional and personal development.

Where we are

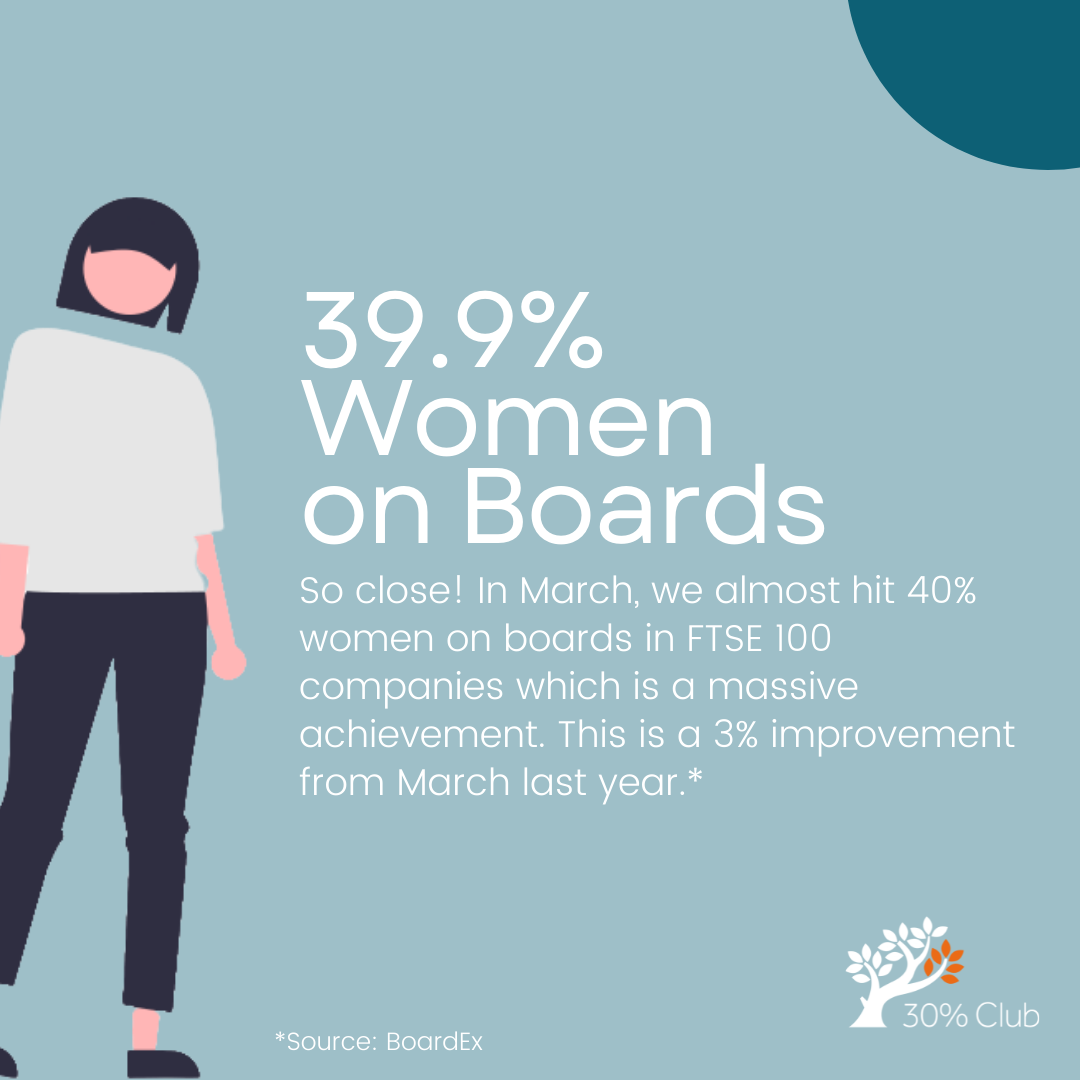

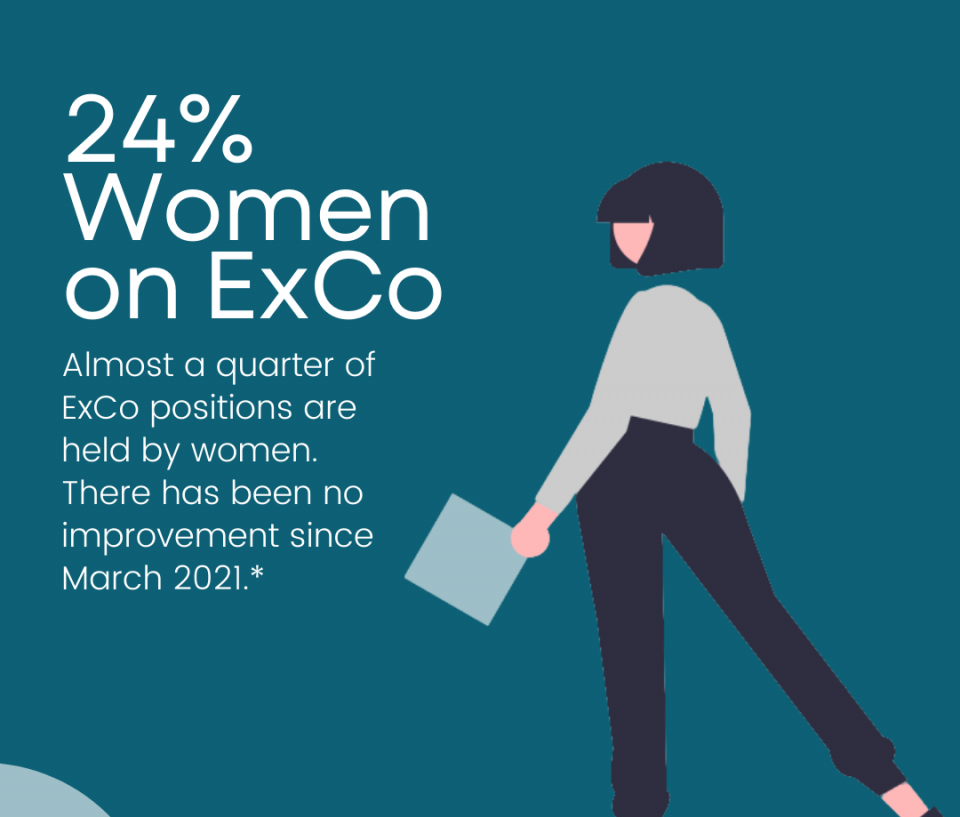

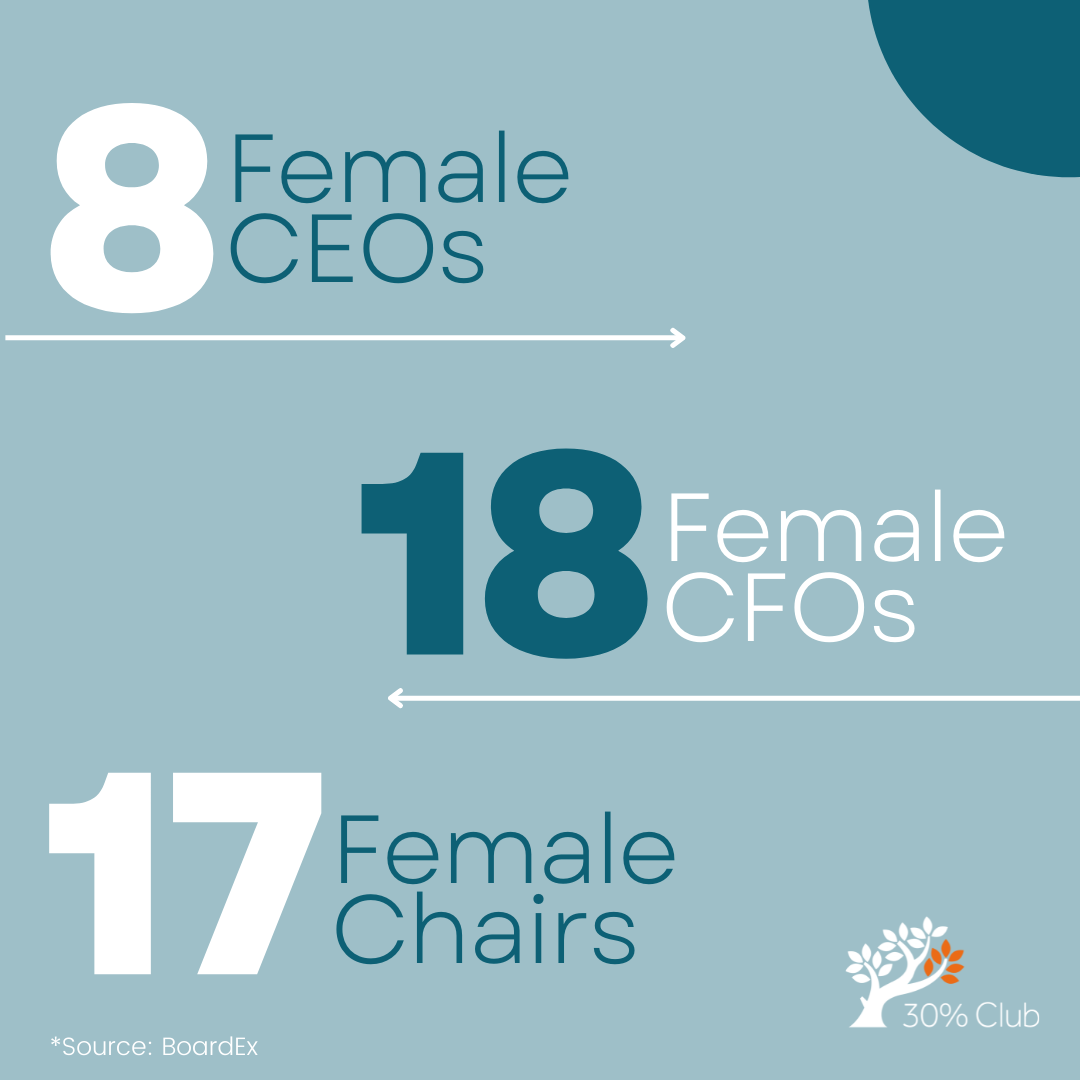

The 30% Club has come a long way from when it was set up in the UK in 2010.We now span six continents and more than 20 countries. We’re actively expanding into more G20 countries