Różnorodność nie jest kwestią szczęścia czy zbiegu okoliczności. Zaczyna się od kultury różnorodności i włączenia.

Read the interview in English

Milena Olszewska-Miszuris: Hedwige, bardzo dziękuję za przyjęcie zaproszenia do wywiadu ESG 12on12! To zaszczyt rozmawiać z Tobą. W ostatnim czasie osiągnęłaś ogromny sukces – pomogłaś wprowadzić w życie dyrektywę Women on Boards. Dyrektywa zobowiązuje kraje członkowskie UE do ustanowienia kwot na określony procent kobiet na najwyższych stanowiskach. Dlaczego w XXI wieku potrzebujemy prawa, które gwarantuje równość kobiet i mężczyzn firmach?

Hedwige Nuyens: Bardzo dziękuję za zaproszenie. Bardzo się cieszę, że mogę podzielić się z Tobą moimi poglądami.

Jak powiedziała przewodnicząca Ursula von der Leyen w swoim styczniowym wystąpieniu, kiedy zmiany nie przychodzą naturalnie, potrzebne są regulacje. Widzimy, że liczba kobiet we władzach spółek jest bardzo zróżnicowana w poszczególnych krajach. We Francji mamy obecnie ponad 45%, w Estonii niewiele ponad 8%. Dzięki tej dyrektywie będziemy świadkami zmian w całej Europie, we wszystkich branżach.

Milena Olszewska-Miszuris: W 2012 roku zaproponowano dyrektywę w sprawie władz spółek giełdowych określającą cele dotyczące minimalnego 40% udziału kobiet. Dyrektywa została zatwierdzona przez Komisję Europejską i Parlament Europejski. Została jednak zablokowana przez Radę Europejską. Jaki był powód wyciszenia tak ważnej dyrektywy?

Hedwige Nuyens: To dobre pytanie, a odpowiedź może być zaskakująca. Niektóre kraje, takie jak Szwecja, wyrażały sprzeciw, nie dlatego, że nie wspierają kobiet. Wręcz przeciwnie, mają jedną z najwyższych reprezentacji kobiet we władzach spółek. Dla nich była to kwestia zasad, firmy powinny mieć prawo do samodzielnego decydowania o tym, kogo mianować, regulacje nie powinny się w to mieszać. Inne kraje, jak Holandia, długo były przekonane, że zmiany przyjdą automatycznie, z czasem, że nie potrzeba żadnych regulacji. W Niemczech istniał silny sprzeciw świata korporacyjnego wobec kwot. Tak wiele powodów, ale udało nam się przekonać kraje do zmiany zdania. A dyrektywa uzyskała poparcie prawie wszystkich krajów, 2 były przeciw (Polska i Szwecja).

Milena Olszewska-Miszuris: Jak zmieniła się sytuacja na przestrzeni dekady? Czy straciliśmy tyle lat, czy może różnorodność we władzach spółek wzrosła na przestrzeni lat?

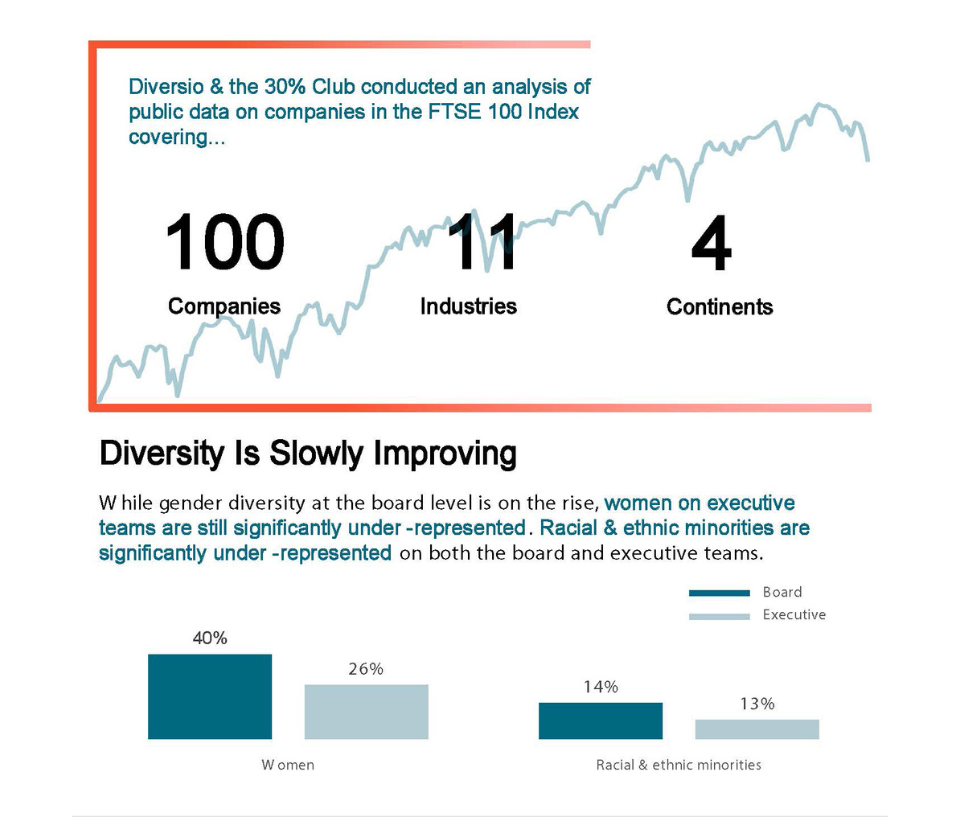

Hedwige Nuyens: Tak, na szczęście różnorodność wzrosła, z prawie 20 do średnio 30% kobiet na najwyższych szczeblach hierarchii korporacyjnej. I mamy teraz 4,5 roku na przejście z 30 do 40%. Ten cel musi być zrealizowany do 30 czerwca 2026 roku.

Milena Olszewska-Miszuris: Jakie argumenty przekonały UE do powrotu do dyskusji na temat kwot? Jakie są kluczowe punkty dyrektywy Women in Boards? Jakich aspektów najwyższego szczebla hierarchii korporacyjnej dotyka dyrektywa?

Hedwige Nuyens: Jednym z głównych argumentów było właśnie to, że dyrektywa nie mówi już o kwotach, ale o celach. Każde przedsiębiorstwo będzie musiało wyznaczyć cel dotyczący liczby kobiet i będzie musiało wprowadzić plan działania oraz publikować informacje o poczynionych postępach. Innym argumentem, który pomógł, jest oczywisty postęp, jaki można było zaobserwować w krajach, które podjęły działania (kwoty pomagają najbardziej, ale nawet łagodniejsze działania mogą mieć znaczenie). Dzięki dyrektywie będziemy mieć silne ramy w 27 krajach. Jesteśmy bardzo dumne, jako European Women on Boards, że przyczyniłyśmy się do osiągnięcia porozumienia w sprawie tego tekstu. Pracowałyśmy niezwykle ciężko, dzień i noc, przez wiele miesięcy.

Milena Olszewska-Miszuris: Dyrektywa nakłada na kraje Unii Europejskiej obowiązek wyboru pomiędzy 40% kobiet jako dyrektorów niewykonawczych (członków rad nadzorczych) lub 33% kobiet we władzach (zarządach i radach nadzorczych). Dlaczego dano taki wybór? Rola dyrektorów niewykonawczych jest inna niż dyrektorów wykonawczych. Czy jeden wybór jest lepszy od drugiego? Jakie aspekty powinni brać pod uwagę politycy dokonując wyboru?

Hedwige Nuyens: To był wynik długiej debaty. Sytuacja może być różna w różnych krajach. Ład korporacyjny nie jest wszędzie taki sam. W świecie anglosaskim powszechne jest posiadanie tylko rady dyrektorów, z dyrektorami wykonawczymi i niewykonawczymi. Na kontynencie często mamy do czynienia z zarządami i radami nadzorczymi. W Holandii i Niemczech można mieć nawet 3 warstwy decyzyjne. Tak więc, w zależności od kraju, sensowne może być wyznaczenie celu tylko dla rady nadzorczej lub dla zarządu i rady nadzorczej łącznie. Oba systemy mogą działać i mieć znaczenie.

Milena Olszewska-Miszuris: Czy dyrektywa na pewno wejdzie w życie, czy też istnieje jeszcze ryzyko, że zostanie odłożona na półkę jak dekadę temu?

Hedwige Nuyens: Nie, mamy porozumienie polityczne oraz akceptację wszystkich stron. Tekst jest poddawany ostatecznym kontrolom prawnym, ale oczekujemy, że zostanie wkrótce opublikowany.

Milena Olszewska-Miszuris: UE składa się z krajów o zróżnicowanym poziomie kobiet na najwyższych stanowiskach. Np. Francja jest jednym z liderów różnorodności płci we władzach z kwotami obowiązującymi od lat. Polska jest po przeciwnej stronie z ograniczonym wsparciem dla różnorodności – mamy Dobre Praktyki Spółek Giełdowych 2021 z dwoma zasadami definiującymi zróżnicowany pod względem płci zarząd i radę nadzorczą jako takie, w których niedoreprezentowana płeć ma co najmniej 30% miejsc. Jak widzisz szanse na wdrożenie dyrektywy w tak wielu krajach o różnym stopniu różnorodności?

Hedwige Nuyens: Nie jest to pierwszy raz, kiedy dyrektywa jest głosowana. Kraje są więc do tego przyzwyczajone. W dyrektywie przewidziano ścisłą procedurę i harmonogram, które pomogą państwom wdrożyć zasady. Dużą zaletą pracy z dyrektywą jest to, że kraje mogą dostosować rozporządzenie do swoich potrzeb, tak aby lepiej pasowało do ram prawnych i ładu korporacyjnego obowiązujących w ich kraju. Obiecałyśmy Komisji Europejskiej, że jako European Women on Boards pomożemy we wdrażaniu dyrektywy.

Milena Olszewska-Miszuris: Prowadząc kampanie na rzecz różnorodności w 30% Club Poland często słyszymy, że najwyższe stanowiska powinny być obsadzane w oparciu o kompetencje i że po prostu nie ma wystarczającej liczby wykwalifikowanych i doświadczonych kobiet, które mogłyby obsadzić stanowiska w zarządach i radach nadzorczych. Jakie jest Twoje zdanie w tej sprawie?

Hedwige Nuyens: Najwyższe stanowiska powinny być oparte o kompetencje. Dyrektywa wyraźnie zajmuje takie stanowisko. Dlatego zachęca się firmy, by przejrzyście przedstawiały profil poszukiwanych dyrektorów wykonawczych i niewykonawczych i potrzebne kompetencje. Będą musiały uczynić proces rekrutacji bardziej przejrzystym i wyjaśnić, dlaczego wybrały tego, a nie innego kandydata. Tak więc celem jest posiadanie najlepszych osób we władzach spółek europejskich. Dziwne jest jednak to, że kiedy we władzach zasiadają wyłącznie mężczyźni, nikt nie zadaje pytania, czy są oni rzeczywiście najlepszymi możliwymi kandydatami.

Milena Olszewska-Miszuris: Jednym z elementów jest wprowadzenie Dyrektywy do prawa krajów członkowskich, drugim jej wykonanie. Jakich rad udzieliłabyś władzom spółek, aby zaczęły czynić swoją pulę talentów na najwyższych stanowiskach bardziej zróżnicowaną? Jakie rozwiązania okazują się skuteczne, a jakich należy unikać?

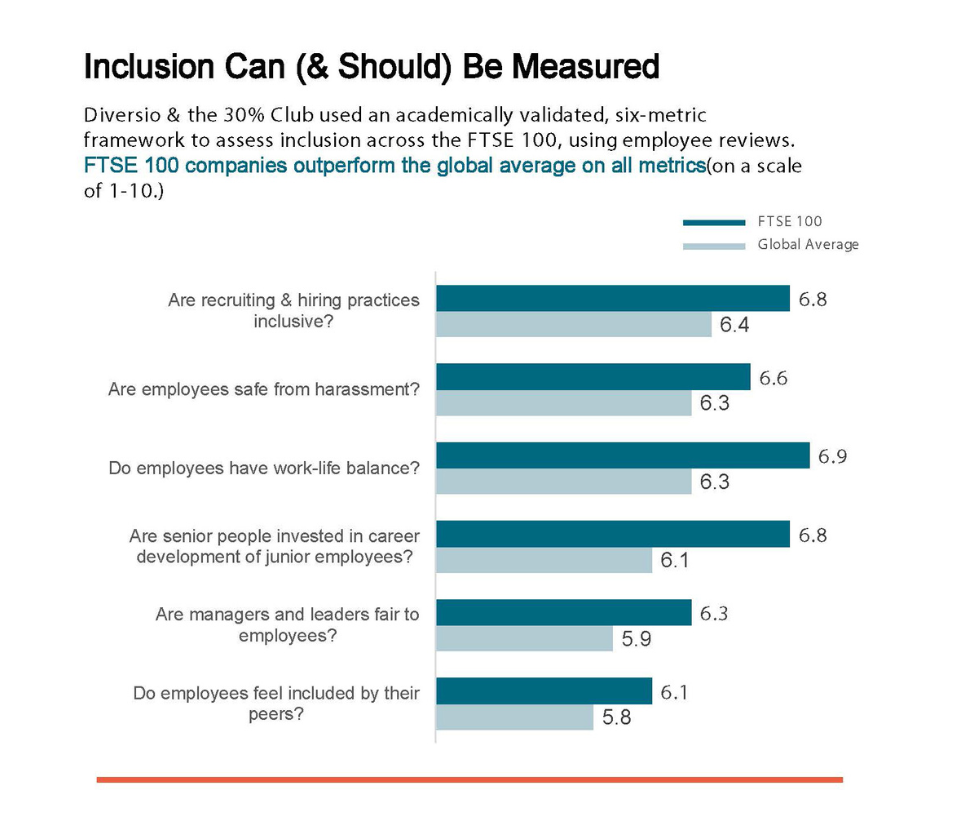

Hedwige Nuyens: Różnorodność nie jest kwestią szczęścia czy przypadku. Zaczyna się od kultury różnorodności i włączenia w firmie. Ale to wymaga czasu. Spółki giełdowe bardzo często korzystają z usług firm executive search w celu zaproponowania lub oceny kandydatów. Dobrym początkiem może być współpraca tylko z tymi firmami, które mają dobre referencje, jeśli chodzi o kandydatki. Można zapytać o ich osiągnięcia: ile kandydatek do władz mają w swojej puli talentów? Czy mogą zapewnić równą liczbę kobiet i mężczyzn na swojej długiej i krótkiej liście? Jaka jest liczba kobiet mianowanych przez nich w ostatnich 20 poszukiwaniach?

Milena Olszewska-Miszuris: Dotychczas omawialiśmy formalną część różnorodności we władzach. A co z częścią nieformalną? Czy jako kobiety naprawdę musimy naginać się do męskiego świata, aby zostać zaakceptowane? Jakie są prawdziwe bariery, na które napotykają kobiety we władzach?

Hedwige Nuyens: Naginanie się byłoby marnowaniem naszego talentu. Moje osobiste doświadczenie jest takie, że w miarę jak awansowałem w mojej karierze, moje miękkie umiejętności były coraz ważniejsze. Oczywiście, mam wiedzę z zakresu finansów, zarządzania i prawa. Ale moją główną siłą jest zdolność do słuchania, rozumienia różnych interesów, umiejętność doprowadzenia stron do kompromisu. To są tzw. cechy kobiece, ale bardzo pożądane na szczycie.

Milena Olszewska-Miszuris: Walka o prawa kobiet, czyli o prawa człowieka nie jest łatwa, przynajmniej dla mnie, ale jest niezwykle ważna. Zawsze, gdy widzę Cię na webinarach lub zdjęciach, masz uśmiech na twarzy i jesteś pełna entuzjazmu. Skąd bierzesz swoją energię?

Hedwige Nuyens: Chciałabym za to złożyć wyrazy uznania mojemu mężowi. Kilka razy w swojej karierze zmagałam się z problemami, wzloty i upadki są częścią życia. On zawsze zadawał to samo pytanie: Co chciałabyś robić? Mogłam robić co tylko chciałam, byleby widział, że jestem szczęśliwa. I za każdym razem szłam za jego radą.

Milena Olszewska-Miszuris: Pokolenia, które obecnie wkraczają na rynek pracy, są ważne dla zmian w kierunku równości płci. Jakich wskazówek udzieliłabyś młodym mężczyznom i kobietom wchodzącym do korporacji i instytucji? Czego powinni być świadomi?

Hedwige Nuyens: Wybierz środowisko, które nagradza twój talent, wybierz pracę, która cię spełnia. Życie jest zbyt krótkie, by robić coś, co czyni cię nieszczęśliwym. Istnieje tak zwana wojna o talenty. Bądź ciekawy/a, bądź odważny/a, poczuj strach i rób to mimo wszystko. To moja ulubiona dewiza. I – oczywiście – nie przestawaj się uśmiechać.

Rozmowa jest częścią serii wywiadów ESG 12on12 przeprowadzanych przez Milenę Olszewską-Miszuris. Oryginalny tekst dostępny poniżej:

Read the interview (English version)

Przeczytaj wywiad (wersja polska)