„Niech nas usłyszą!” to raport pokazujący mocny głos 4 262 aktywnych zawodowo kobiet o zróżnicowanej sytuacji rodzinnej, pracujących na rozmaitych stanowiskach w firmach z szeregu różnych sektorów. Jest to unikalna diagnoza przyczyn niskiej reprezentacji kobiet na wyższych stanowiskach kierowniczych.

Zdecydowana większość uczestniczek badania chce awansować (91,1%) i nigdy nie zrezygnowała z szansy awansu (70,4%). Ponad połowa respondentek wskazała, że ich płeć była przesłanką do gorszego traktowania (52,1%) oraz wyraziła przekonanie, że wymagania stawiane wobec kobiet są wyższe niż wobec mężczyzn na równorzędnych stanowiskach (55,7%). Niezależnie od wieku, sytuacji rodzinnej czy zawodowej, kobiety spotykały się z licznymi stereotypami na swojej ścieżce kariery. Wśród rozwiązań ułatwiających podejmowanie nowych wyzwań zawodowych najczęściej wskazywały podwyżki czy wynagrodzenie za dodatkowe obowiązki (70,9%) oraz elastyczne podejście do miejsca (58,0%) i czasu pracy (55,0%).

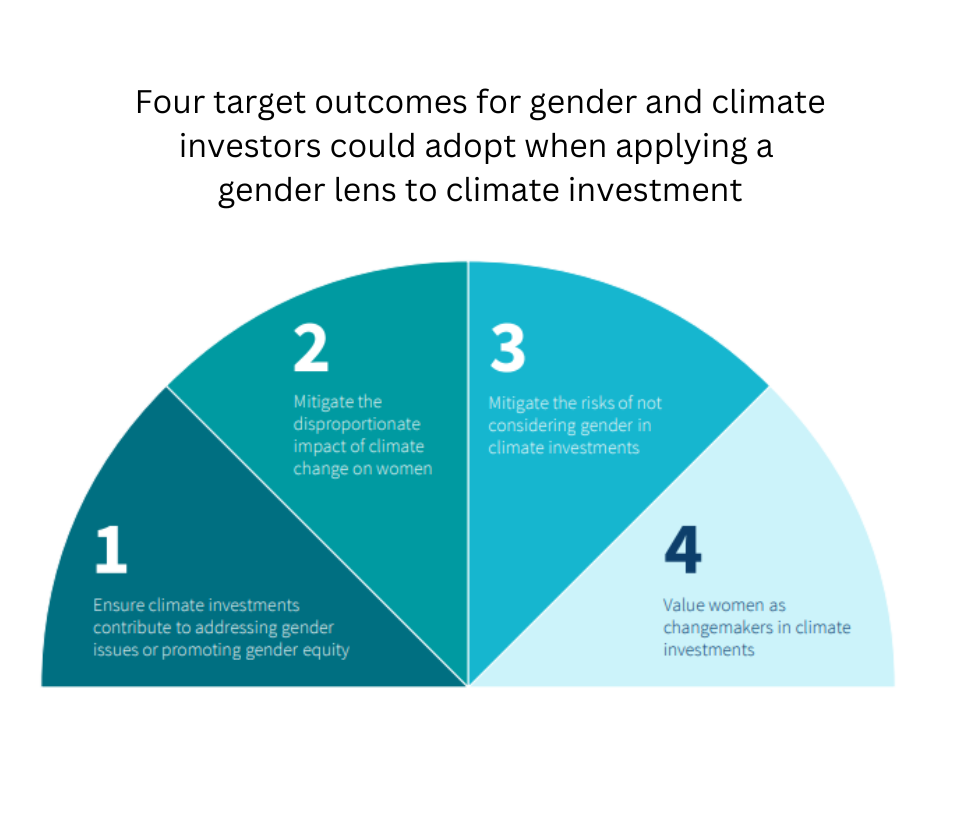

Raport dostarcza cennych wskazówek, jak zwiększyć wykorzystanie całej puli talentów w firmie. Kluczową z nich jest realizowanie inicjatyw z zakresu różnorodności, równych szans i włączenia (DEI). Firmy w nie zaangażowane częściej oferowały takie same szanse awansu i rozwoju, a kobiety w nich zatrudnione częściej czuły się traktowane na równi z mężczyznami na porównywalnych stanowiskach, zarówno ze względu na płeć, jak i sytuację rodzinną.

KOBIETOM NIE BRAK KWALIFIKACJI, ALE ICH UDZIAŁ WE WŁADZACH JEST WCIĄŻ NISKI

Kobiety stanowią 51,7% społeczeństwa oraz 62,9% absolwentów studiów wyższych w Polsce, w tym 65,8% na kierunkach ekonomicznych, prawniczych, zarządzania i administracji. Jednak ich udział w zarządach i radach nadzorczych spółek pozostaje niski i nie ulega znaczącej poprawie. Na koniec 2022 roku udział kobiet we władzach 140 największych spółek giełdowych wyniósł zaledwie 17,2% (jedynie 0,6 pp. więcej niż rok wcześniej), a na czele tylko 3 z nich (2,1%) stała prezeska zarządu. Szukając przyczyny niskiej reprezentacji pań na wyższych stanowiskach kierowniczych, twórcy badania oddali głos szerokiemu gronu kobiet.

Badanie „Niech nas usłyszą! Głos kobiet w korporacjach” zostało zrealizowane między 17 października a 30 listopada 2022 roku, a jego wyniki bazują na odpowiedziach 4 262 aktywnych zawodowo kobiet w różnym wieku, o zróżnicowanej sytuacji rodzinnej, pracujących na rozmaitych stanowiskach w firmach z szerokiej gamy sektorów. Uczestniczki badania reprezentowały ponadprzeciętnie wysoki poziom wykształcenia, ponieważ aż 94,7% posiadało wykształcenie wyższe. Zdecydowana większość z nich pracowała w dużych miastach, powyżej 200 tysięcy mieszkańców (90,0%), w dużych organizacjach, zatrudniających więcej niż 1 000 pracowników (61,5%). Większość ankietowanych była w długoterminowym związku (76,1%) oraz posiadała dzieci (53,9%).

KOBIETY CHCĄ AWANSOWAĆ, ALE ICH SZANSE AWANSU NIE SĄ RÓWNE

Odpowiedzi kobiet pytanych o ich ogólny stosunek do kariery nie pozostawiają wątpliwości – przeważająca większość (91,1%) stwierdziła, że awans i sukces zawodowy są dla nich ważne. Ponad trzy czwarte z nich (76,5%) uznało, że kobietom zależy na awansie i karierze tak samo jak mężczyznom. Prawie co druga (46,5%) uczestniczka badania była zainteresowana karierą na najwyższych szczeblach hierarchii korporacyjnej, co zaprzecza stereotypowemu myśleniu, że kobiety wolą zajmować mniej eksponowane stanowiska. Co więcej, badanie wykazało, że zdecydowana większość ankietowanych nigdy nie zrezygnowała z szansy awansu (70,4%), a te którym się to zdarzyło najczęściej kierowały się powodami rodzinnymi.

Blisko połowa ankietowanych (45,7%) oceniła, że kobiety z jej branży nie otrzymują równych szans na awans czy rozwój w porównaniu z mężczyznami na podobnych stanowiskach. Prawie co trzecia respondentka (29,7%) stwierdziła, że również ona nie otrzymuje równych szans na awans i rozwój w obecnym miejscu pracy. Jednocześnie ponad połowa uczestniczek badania (55,7%) uważała, że kobietom stawia się wyższe wymagania, niż mężczyznom na równorzędnym stanowisku. Większość ankietowanych mogła jednak liczyć na wsparcie swojego bezpośredniego przełożonego, zarówno szefa jak i szefowej. Dane przeczą dość powszechnemu stereotypowi, że kobiety się nie wspierają, bo panie, których bezpośrednią przełożoną była kobieta, częściej deklarowały, że czują się wspierane w rozwoju niż te, których przełożonym był mężczyzna.

Raport 30% Club Poland jest donośnym głosem aktywnych zawodowo kobiet, który dostarcza dużo potrzebnych danych oraz zachęca by na nich opierać rozwiązania i praktyki budujące włączającą kulturę organizacyjną pracodawcy. Dyskusja w przestrzeni publicznej na temat niskiej reprezentacji kobiet na najwyższych stanowiskach często oparta jest o subiektywne odczucia, czasami krzywdząco przypisujące źródło wielu problemów samym kobietom, ich osobowości czy cechom charakteru, np. że to kobiety nie chcą awansować. Nasze badanie daje unikalną szansę by tę debatę przenieść na zupełnie inne tory i skupić się na zidentyfikowanych barierach i proponowanych rozwiązaniach.

PŁEĆ JAKO CZYNNIK DETERMINUJĄCY NIERÓWNE TRAKTOWANIE

Pytane o cechy, które warunkują odmienne traktowanie ankietowane najczęściej wskazywały płeć. Ponad połowa uczestniczek badania (52,1%) oceniła, że jest traktowana dużo gorzej lub nieco gorzej niż mężczyzna na równorzędnym stanowisku ze względu na fakt bycia kobietą. Częściej taką odpowiedź wybierały respondentki w wieku 41-50 lat oraz 51-60 lat (odpowiednio 57,9% i 57,7%), czyli już z bogatym dorobkiem zawodowym, dla których kwestia awansu na najwyższy szczebel korporacyjny, obecnie zdecydowanie częściej zajmowany przez mężczyzn, stawała się istotna.

Z kolei co trzecia ankietowana (34%), która posiadała dzieci, czuła się gorzej traktowana ze względu na swoją sytuację rodzinną, przy czym odsetek ten był wyższy dla matek posiadających dzieci w wieku 0-3 lat (45,6%). Wśród innych cech warunkujących gorsze traktowanie kobiety wymieniły jeszcze wiek i cechy czysto fizyczne, takie jak młody wygląd, atrakcyjność, postura, wzrost, uśmiech i wysoki głos.

Gorsze traktowanie kobiet przybierało bardzo różną formę. Najczęstszym doświadczeniem zdecydowanej większości uczestniczek badania (68%) były komentarze dotyczące ich wyglądu, zarówno te pozytywne, jak i negatywne. Co druga z kobiet spotkała się ze stereotypizacją jej zachowań (52,0%) czy niemiłymi komentarzami w odniesieniu do jej płci (51,8%). Ponad jedna czwarta (27,5%) zetknęła się z uporczywym przerywaniem i brakiem możliwości dojścia do głosu, a co czwarta uczestniczka badania (25,1%) skarżyła się na ignorowanie zgłaszanych przez nią pomysłów.

Równość płci i takie same szanse kobiet i mężczyzn są niezbędne, abyśmy mogli mówić o realizacji modelu zrównoważonego rozwoju. Dlatego też United Nations Global Compact w swojej globalnej strategii stawia Cel 5. Zrównoważonego Rozwoju ONZ (Równość płci) w gronie najważniejszych celów dla naszej organizacji. Jako UN Global Compact Network Poland dołączyliśmy do badania 30% Club Polska, aby oddać głos samym zainteresowanym - kobietom. Poprzez ankiety przeprowadzone wśród pracowniczek sektora prywatnego podjęliśmy próbę zdiagnozowania przyczyn niskiej reprezentacji kobiet na wyższych stanowiskach kierowniczych i barier, które stoją na drodze rozwoju zawodowego kobiet w korporacjach.

Takie negatywne doświadczenia, z którymi mierzyły się kobiety w miejscu pracy, znalazły odzwierciedlenie w barierach, które ograniczały im dostęp do wyższych stanowisk. Respondentki wskazywały na brak pewności siebie oraz obawę przed porażką czy krytyką jako barierę w rozwoju. Kobiety wysoko oceniły też przeszkodę w postaci braku odpowiedniej sieci kontaktów zawodowych, duże obciążenie obowiązkami rodzinnymi oraz kwestie powiązane z tradycyjnym podziałem ról i presją społeczną.

KRZYWDZĄCE STEREOTYPY W MIEJSCU PRACY

Wyniki badania pokazują, że często nie sama płeć, ale również związane z nią stereotypy, czyli nadmierne uogólnienia i uproszczone przeświadczenia stanowiły barierę w karierze zawodowej kobiet. Analiza wykazała, że stereotypy w miejscu pracy są nadal obecne. Niewiele było uczestniczek badania, które by się przed nimi uchroniły. Jedynie 32 respondentki (0,8%) nigdy nie spotkały się z żadnym z wymienionych w badaniu stereotypów. Połowa uczestniczek badania często lub bardzo często mierzyła się ze stereotypem, że „ambitne kobiety są trudne do współpracy” (52,5%) oraz że „kobietami nawet w pracy rządzą emocje/hormony” (49,8%). Wciąż żywy okazał się stereotyp, że „kobiety nie radzą sobie w sprawach technicznych, ale lepiej radzą sobie w obszarach humanistycznych” – 45,8% ankietowanych wskazywało na jego częstą obecność.

ROZWIĄZANIA WYRÓWNUJĄCE SZANSE – POTRZEBNE SĄ DZIAŁANIA

Wyniki badania pokazują, że istnieją rozwiązania, których wdrożenie pomogłoby firmom wyrównać szanse. Analiza wykazała, że kobiety zatrudnione w firmach realizujących inicjatywy z zakresu różnorodności, równych szans i włączenia (ang. diversity, equity & inclusion, DEI) częściej otrzymywały takie same szanse rozwoju i awansu, jak mężczyźni na podobnych stanowiskach. Częściej były one też zadowolone z pracy i czuły się traktowane na równi z mężczyznami, zarówno ze względu na płeć, jak i sytuację rodzinną. Rzadziej również zgłaszały, że spotykały się z negatywnymi stereotypami w trakcie swojej kariery zawodowej.

Niezależnie od wieku czy sytuacji rodzinnej, pytane co pomogłoby im podjąć się nowych wyzwań, kobiety najczęściej wskazywały (70,9%) na kwestie finansowe, takie jak podwyżki czy wynagrodzenie za dodatkowe obowiązki, a co trzecia (34,8%) sugerowała zrównanie płac kobiet i mężczyzn na tych samych stanowiskach. Wśród narzędzi i działań, które mogłyby podjąć firmy, respondentki wysoko ceniły również elastyczne formy pracy (58,0% wskazało na elastyczne podejście do miejsca pracy, a 55,0% na elastyczny czas pracy) i różnego rodzaju programy rozwojowe, takie jak szkolenia czy mentoring.

Aby ułatwić drogę do zbudowania inkluzywnej kultury korporacyjnej, 30% Club Poland wydał autorski Przewodnik DEI. Przewodnik można pobrać pod poniższym linkiem:

Odpowiedzi uczestniczek badania wskazują, że w dominującej części chcą one awansować i sięgać po więcej, również po te najwyższe stanowiska. To dobra wiadomość dla firm, które cenią różnorodność w swoich władzach. Aby wykorzystać ten potencjał i talent, priorytetem dla liderów i liderek powinna być eliminacja barier i tworzenie inkluzywnej kultury, dającej równe szanse każdemu. Badanie pokazuje jak bardzo wielowymiarowe jest to wyzwanie. Oprócz płci, prowadzone inicjatywy powinny brać pod uwagę choćby wiek czy sytuację rodzinną pracowników – te elementy także warunkowały potrzeby i odczucia uczestniczek badania. Droga firm do różnorodności, równych szans i włączenia powinna być ustrukturyzowana i dostosowana do ich sytuacji oraz dojrzałości kultury korporacyjnej. Warto ją rozpocząć już dziś.