Category: News

Brain tumour survivor on why Mission Include mentoring is so important for her

A year ago, commercial banker Jessica Jones underwent a life-saving operation to remove a brain tumour that left her unable to walk unassisted.

Since then, not only has the 38-year-old mum of three from Swansea returned to the job that she loves but she’s also embarking upon a journey of personal development by being mentored on the 30% Club cross-company mentoring programme Mission INCLUDE.

It was important to Jessica to explain this life-changing experience to her mentor at their first meeting in November. Her diagnosis 18 months earlier changed her outlook on life and her career and will be a big part of her mentoring journey.

At its core, Mission INCLUDE is a structured cross-company mentoring programme that expertly pairs senior business leaders with mentors outside of their industry to challenge and help them progress.

Jessica is a relationship director at NatWest with responsibility for financing SMEs with turnovers of up to £50 million. She has been paired with mentor Laura Pingree, a partner at accountancy firm BDO LLP, who specialises in energy and mining.

During their first meeting, Jessica revealed how the excitement of receiving a promotion in March 2020 was overshadowed, three months later, by the devastating news that she would require life-saving surgery.

“I didn’t want sympathy, but I wanted her to know the journey I’d been on and why I was so determined to get the most out of this experience,” she says.

Jessica explained to Laura that after suffering hearing loss, headaches and tinnitus since 2019, she saw her GP in June 2020, who prescribed migraine tablets. But when the symptoms didn’t improve after a couple of days, she was referred to hospital for a CT scan.

While waiting for that appointment, her blood pressure became abnormally high, so she attended Prince Phillip hospital in her hometown of Llanelli, Carmarthenshire. After two days of tests – and while sat alone due to Covid restrictions – Jessica was given the devastating news that she had an acoustic neuroma causing pressure on her brain stem.

“I was in total shock. Hearing those words, ‘you’ve got a brain tumour’ was terrifying. I was absolutely petrified and burst into tears,” says Jessica.

Backlogs caused by the pandemic meant she had to wait until January 2021 for surgery.

During a gruelling 13-hour operation, which involved removing a section of skull from behind Jessica’s ear, surgeons successfully removed most of the tumour. They advised to leave a small part of the tumour which had grown around the facial nerve, so not to cause facial palsy. The procedure has left her with single sided deafness and a CROS hearing aid.

She was kept in hospital for two weeks. Covid restrictions meant that Jessica’s husband Mark and their daughters Ella who is eight, and five-year-old twins Emily and Lily, couldn’t visit her.

“I was unable to stand the first few days without vomiting due to the vertigo, and each day challenged myself a little more. Thanks to the support of the team there, I finally left the hospital trundling along on a Zimmer frame at the age of 37,” she says. “When I was home, I paid for weekly sessions with a neuro-physio who helped me build the confidence and strength to walk without the frame.”

Her diagnosis left her fatigued and sometimes unable to walk more than 2,000 steps a day, but in September 2021, Jessica was keen to return to the job that she loves.

“Natwest has fully supported me since the moment I was diagnosed and on the path towards rehabilitation,” says Jessica. “We spoke about both my personal and career development and I explained that I thought that being mentored by someone outside of banking would help develop me as an individual. They recognised what I had been through – and the journey that still lies ahead – and I’m grateful they gave me special approval to take part in Mission INCLUDE.

“In the 14 years I’ve worked for NatWest, I’d previously been on excellent courses that were bank focused and I have always been very passionate and committed in taking responsibility for my career progression. I knew that I would benefit from having an outside mentor challenge me, hold me accountable and offer external perspective on my development.”

Jessica admits she was initially surprised by who she was paired with.

“When I first read Laura’s profile, I was unsure as to why we’d been put together as our experience looks so different on paper. But I soon realised we are so well matched. Our personalities are very, very different but whatever algorithms Moving Ahead use to match people, it definitely works!

“We are very open with each other about our lives and our experiences. You need that openness, otherwise the mentoring would be very scripted.”

At their most recent meeting in January, Laura challenged Jessica to apply to sit on a non-executive board during the nine-month programme – something that would help give her exposure to other business issues that could be of use to her in NatWest.

In preparation, she’s also been tasked with gathering 360° feedback from colleagues to see if the areas that Jessica thinks that she needs to develop align with those they suggest.

“I questioned who would want me on their board, but by sharing her own experiences, Laura was able to reassure me that I have transferable skills and that businesses in sectors outside of banking – and outside of my comfort zone – would welcome,” she says. “And I now realise the experience would greatly aid me in my development within NatWest.”

Aside from the one-to-one mentoring, Mission INCLUDE offers other benefits.

“The programme includes regular Zoom events with participants from around the world, masterclasses to get the best out your development, networking sessions with other mentees, and the opportunity to hear from fantastic, thought-provoking expert speakers,” she says.

A recent talk by coach Holiday Phillips on pushing yourself outside of your comfort zone resonated with her.

“On Christmas Eve, I received the news that the remainder of my tumour is stable and I’ll have yearly scans to monitor what is left of it,” she says. “Having the tumour has taught me is life is too short to be taken for granted and to keep pushing yourself, developing and reflecting. Sometimes that means doing things that you’re a little uncomfortable with, but you may never get the opportunity to do again if you don’t do them now. I want to push myself and do things that perhaps make me feel a little bit uncomfortable.”

Jessica can already see the benefits that the Mission INCLUDE programme will bring to her and NatWest.

“I am already learning lots that I can apply to my current role and future development. Having a mentor share their expertise and encouragement will also help equip me with new skills that I can bring to the bank to assist others,” she says.

And it’s not only at the bank that that Jessica wants to help others. Last month, she embarked on an ambitious 10,000 Steps a Day challenge to fundraise and raise awareness for Brain Tumour Research to help find a cure for the devastating disease as a way of thanking all those who helped her. She raised more than £2,500. If you would like to donate, click here for more information.

Where we are

The 30% Club has come a long way from when it was set up in the UK in 2010.We now span six continents and more than 20 countries. We’re actively expanding into more G20 countries

30% Club UK Investor Group statement on addressing racial inequality

Challenge for change

The 30% Club UK Investor Group has issued a statement addressing the lack of racial and ethnic diversity in UK business and outlined the action it is taking to make positive change.

“As institutional investors, we can contribute to addressing these inequities by taking concrete steps to promote diversity and inclusion across our portfolios and within our organisations,” it states.

Members of the group who have signed up to the statement have more than £11 trillion assets under management.

The group has sent letters to the FTSE 100 companies its independent research suggests have still to meet the Parker Review targets of at least one board member and executive committee member from an ethnic minority background. They were meant to have done so by the end of 2021.

The letter warned the companies that investors may consider voting against companies at their annual general meetings if they fail to take action.

The Investor Group is committed to actively engage with UK company board chairs, nomination committees and executive teams on the issue of racial inequality in their leadership ranks and workforce.

The publication of the statement builds on the UK chapter of the 30% Club introducing race and ethnicity targets in July 2020. Those targets include members of the Club across the FTSE 350 having at least one person of colour at board and executive committee level by the end of 2023*. And as the 30% Club campaign is focused on gender, we expect at least half of those appointments to go to women of colour.

While the 30% Club works directly with CEOs and Chairs to encourage change, the Investor Group’s been working on improving the availability of data on race equity within the FTSE 100 by engaging with ESG data providers and supporting the creation of new data platforms, such as through its partnership with Diversio.

The Group is also running a race equity training programme for its members to ensure that all investors, big and small, are equipped to take action with the companies they invest in.

Diandra Soobiah, co-chair of the 30% Club UK Investor Group, said: “Diversity and inclusion in companies are integral to sound corporate governance and corporate culture. As long-term investors, we see the failure to take diversity seriously as a stark warning about the long-term sustainability of the company.

“Time is up for organisations that seek to simply tick boxes. The 30% Club Investor Group is putting FTSE companies on notice – the laggards need to do much better, and we’re willing to help.

“We all have an important role to play to ensure persistent race inequities in business and our society are addressed. As investors, we can have stronger dialogue with the companies we invest in, with a view to improving diversity and inclusion within companies in the UK.”

Ann Cairns, global chair of the 30% Club, said: “The 30% Club’s UK Investor Group issuing this statement is a significant moment for the UK investor community. With ESG rightfully gaining prominence in the board rooms and executive offices of the world’s biggest companies, addressing racial inequity is imperative for all asset managers.

“It could make a major contribution to delivering the change businesses, economies and societies so desperately need to see. I am tremendously grateful for the hard work done by the co-chairs and members of the 30% Club UK Investor Group to take a stand on racial inequality.”

*The 30% Club’s UK chapter set the 2023 deadline for the FTSE 350 as a stretch target for our FTSE 350 members to help meet the Parker Review target by the end of 2024.

Where we are

The 30% Club has come a long way from when it was set up in the UK in 2010.We now span six continents and more than 20 countries. We’re actively expanding into more G20 countries

FTSE Women Leaders Review Launch

UK closes in on 40% women at board level

The UK has climbed to second in the international rankings for women’s representation at board level.

Almost 40% of UK FTSE 100 board positions are now held by women, compared with 12.5% just ten years ago. And there are almost 38% women on board across the FTSE 350.

The data has been published in a new report by the Government-backed FTSE Women Leaders Review, which monitors women’s representation in 24,000 positions on FTSE 350 Boards and in Leadership teams of the UK’s biggest companies, building on the success of the previous Hampton-Alexander and Davies Reviews.

What this new data from the FTSE Women Leaders Review reiterates is that we don’t need mandates - aspirational targets change not just the numbers but also the culture inside companies.

Key highlights from the report include:

- Almost 40% of UK FTSE 100 board positions are now held by women, putting the UK second in international rankings for board representation.

- FTSE 100, 250 and 350 all improved the number of women in Leadership roles in 2021, with the Government’s and 30% Club’s voluntary, business-led approach paying dividends.

- The new review also sets out bold recommendations to build on this progress, including a voluntary target for FTSE 350 executive leadership teams to achieve 40% female representation by the end of 2025. It is currently less than 20%, according to BoardEx data.

- It is also asking FTSE 350 companies to have at least one woman in the Chair, Senior Independent Director role on the Board and/or one woman in the CEO or CFO by the end of 2025. There are just 18 and 48 at present, that’s 5 and 14% respectively.

- The Review has also increased in scope beyond the FTSE 350 companies to include the largest 50 private companies in the UK by sales.

The 30% Club welcomes the extended focus of the Review.

30% Club Global Chair Ann Cairns said:

Business Secretary, Kwasi Kwarteng, said:

“UK businesses have made enormous progress in recent years to ensure that everyone, whatever their background, can succeed on merit – and today’s findings highlight this with more women at the top table of Britain’s biggest companies than ever before.

“However, we should not rest on our laurels, and the FTSE Women Leaders Review will build on the success so far of our voluntary, business-led approach to increasing women’s representation on boards and in leadership, without the need for mandatory quotas.”

Minister for Women and Equalities, Liz Truss, said:

“It is excellent to see the progress being made, but we know there is more to be done. This Government is committed to levelling up all parts of our country, working to tackle inequality and promoting equality of opportunity, including at senior level, so everyone can thrive.”

Here are the four new recommendations of the FTSE Women Leaders Review in full:

The voluntary target for FTSE 350 Boards & for Leadership teams is increased to a minimum of 40% women’s representation by the end of 2025

- FTSE 350 companies to have at least one woman in the Chair, Senior Independent Director role on the Board and/or one woman in the Chief Executive Officer or Finance Director role by the end of 2025

- Extending the scope of the FTSE Women Leaders Review beyond FTSE 350 companies to include the largest 50 private companies in the UK by sales

These recommendations aim to increase gender balance further, bringing new focus to the appointment of women at the highest levels of British business, particularly in those companies that are still lagging behind.

Where we are

The 30% Club has come a long way from when it was set up in the UK in 2010.We now span six continents and more than 20 countries. We’re actively expanding into more G20 countries

Udział kobiet we władzach spółek giełdowych z WIG140 na koniec 2021

„What gets measured gets done”. Kluczowe znaczenie dla sukcesu kampanii 30% Club mają mierzalne cele, które sobie wyznaczamy, dlatego chcemy podzielić się najnowszymi danymi, które zebraliśmy na koniec 2021 roku.

Postęp kampanii śledzimy na grupie 140 największych spółek notowanych na Giełdzie Papierów Wartościowych w Warszawie, wchodzących w skład indeksów WIG20, mWIG40, sWIG80 (łącznie WIG140). Według nowych danych, udział kobiet we władzach tych spółek wzrósł o 1,1 pp. względem roku poprzedniego z 15,5% do 16,6%. Widzimy więc poprawę, ale tempo zmian jest wciąż zbyt powolne.

W badanych spółkach kobiety częściej można spotkać w radach nadzorczych (18,9%) niż w zarządach (13,1%). Wciąż rzadko zajmują one pozycję prezesek zarządu – było tak tylko w 3,6% przypadków (pięć spółek). Częściej, bo w 15,7% spółek kobiety stały na czele rady nadzorczej.

W MWIG40 ROŚNIE UDZIAŁ KOBIET WE WŁADZACH

Najlepiej, jeśli chodzi o różnorodność władz wypadają tzw. blue chipy, czyli spółki z WIG20, w których kobiety stanowiły 20,8% władz na koniec 2021 r. (lekko wyżej r/r). Z kolei w grupie najmniejszych badanych spółek, znajdujących się w indeksie sWIG80, różnorodność we władzach była wyraźnie mniejsza. Udział kobiet we władzach spółek z sWIG80 na koniec ub.r. był na poziomie 13,9%. Co więcej, wskaźnik ten pogorszył się rok do roku o 0,3 pp.

Pozytywne zmiany zaszły w grupie średnich spółek. W przedsiębiorstwach z mWIG40 udział kobiet we władzach firm wzrósł o 4 pp i wyniósł na koniec 2021 r. 18,5%. Tym samym średnie spółki mocno zbliżyły się do tych największych.

SEKTOR FINANSOWY NAJBLIŻSZEJ PROGU 30%

Podobnie jak rok wcześniej, na koniec 2021 r. najwyższy udział kobiet we władzach miały sektory finansowy oraz rolno-spożywczy – było to odpowiednio 23,6% oraz 19,4%. Warto zwrócić uwagę, że w sektorze finansowym udział kobiet we władzach zwiększył się aż o 3,4 pp w minionym roku. Gdyby takie tempo zmian się utrzymało, ten sektor w ciągu dwóch lat osiągnąłby poziom 30%, który jest newralgiczny według wielu badań, bo to próg, od którego głosy mniejszości zaczynają mieć znaczenie i mają realny wpływ na podejmowane decyzje. Sektor ten jest blisko tego progu, jeśli chodzi o udział kobiet w radach nadzorczych – na koniec 2021 r. wyniósł on 28,3%.

Trzeci pod względem udziału kobiet we władzach był sektor TMT – 17,1%, wzrost o 1,7 pp. Tym samym sektor TMT zastąpił na tej pozycji energetykę, gdzie udział kobiet we władzach spadł o 2,0 pp do 15,3%.

JEDNA PIĄTA SPÓŁEK BEZ ŻADNEJ KOBIETY WE WŁADZACH

Choć badania potwierdzają pozytywny wpływ różnorodności na procesy biznesowe, w wielu spółkach brakuje kobiet we władzach. Na koniec 2021 r. wśród 140 największych notowanych spółek aż w 28 (jednej piątej) z nich nie było ani jednej kobiety w zarządzie, ani radzie nadzorczej.

Najgorzej sytuacja nadal wygląda w sWIG80, gdzie podobnie jak w 2020 r., w aż 20 spółkach nie było kobiet w zarządach i radach nadzorczych. Także sytuacja w mWIG40 nadal pozostawia wiele do życzenia – w 8 spółkach nie było kobiet we władzach firm z mWIG40 (choć jest progres w porównaniu do 13 na koniec 2020 r.).

Z kolei wśród blue chipów, podobnie jak rok wcześniej, nie było spółek bez kobiet we władzach.

18 SPÓŁEK Z PRZYNAJMNIEJ 30-PROC. WYNIKIEM

Pomimo ogólnie niskiego udziału kobiet we władzach spółek, w jednej na osiem badanych firm – czyli w 18 spółkach – osiągnięty lub przekroczony został poziom 30%. Te spółki pokazują, że osiąganie różnorodności płci we władzach jest możliwe. To spółki z różnych sektorów (m.in. finanse, TMT, detal, medyczny), o różnej wielkości (4 firmy z WIG20, 8 z sWIG40 oraz 6 z mWIG80) oraz o różnej strukturze akcjonariatu (zarówno z przewagą polskiego, jak i zagranicznego kapitału).

Widzimy, że pozostaje jeszcze bardzo wiele do zrobienia, więc nie poddajemy się i zwiększamy nasze wysiłki.

Deloitte and 30% Club reveal latest global women in the boardroom stats

Progress but it's slow

Deloitte, in collaboration with the 30% Club, today released the seventh edition of Women in the Boardroom: A Global Perspective.

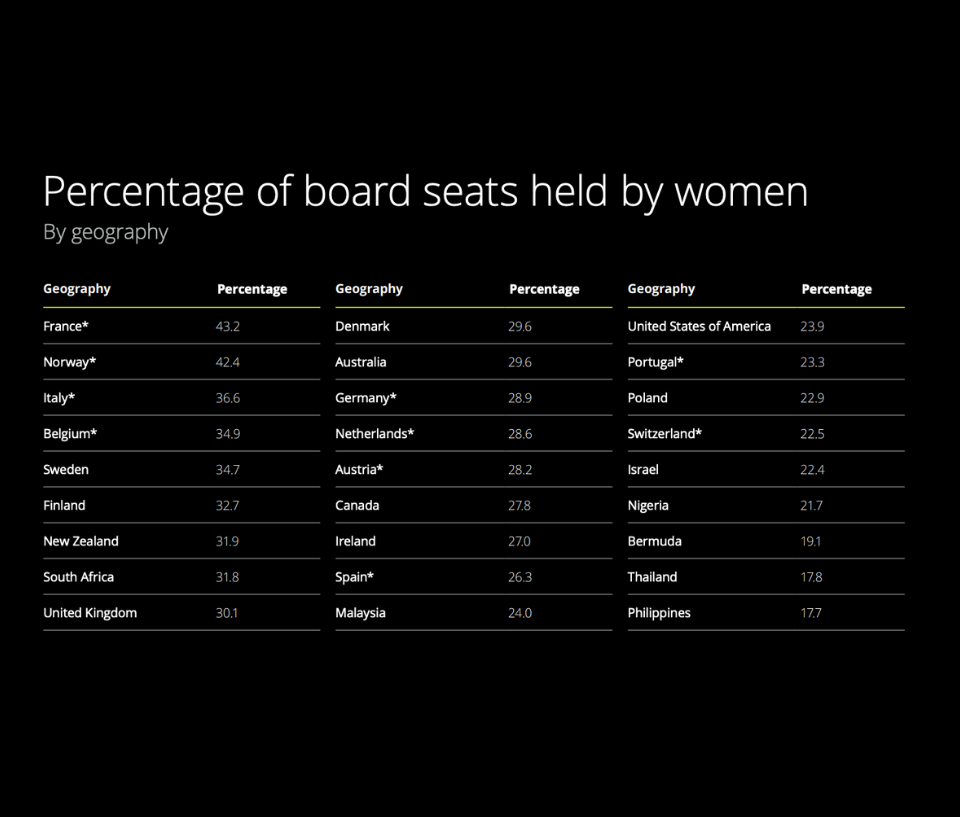

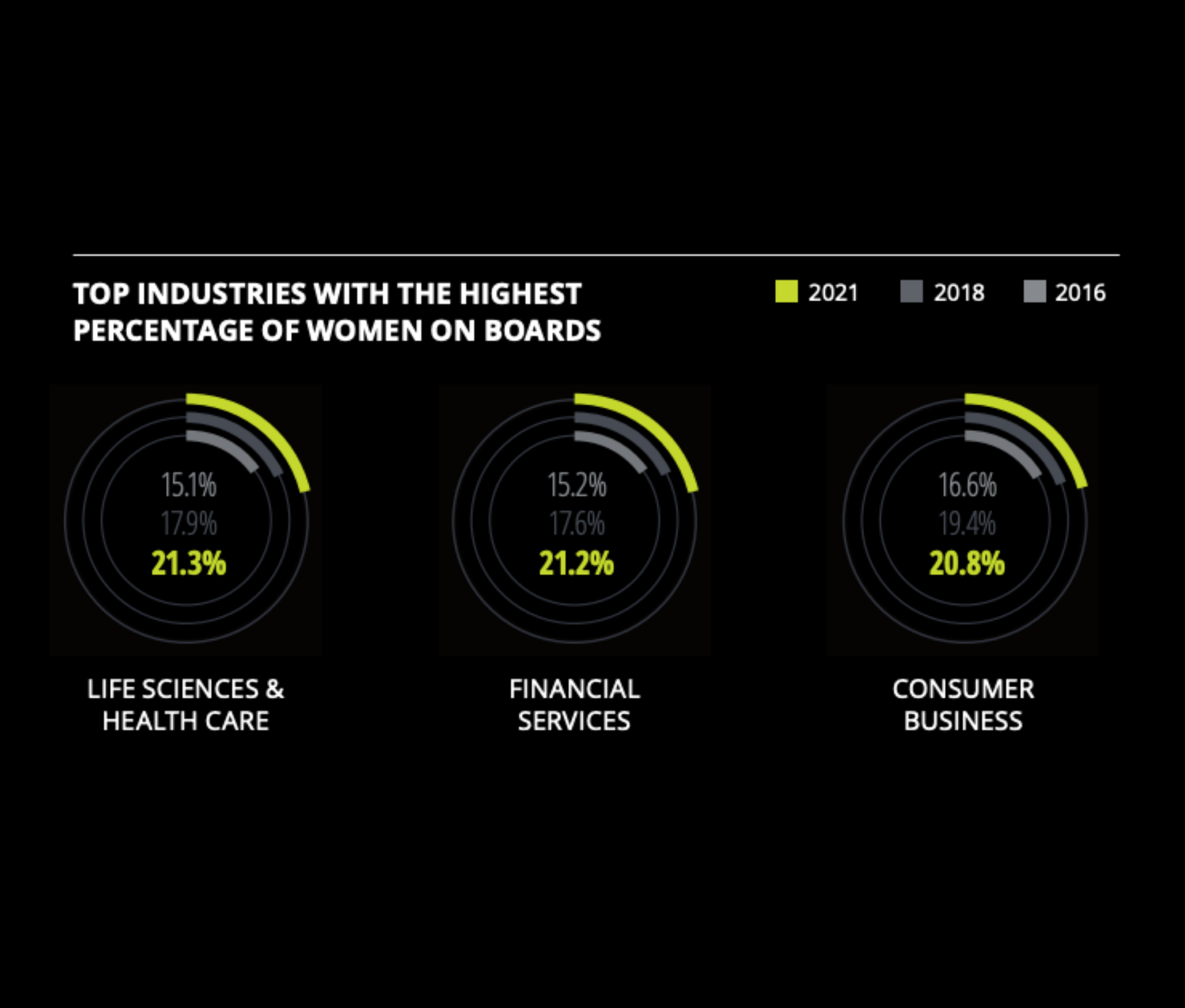

It includes updates from 72 countries on representation of women in the boardroom, exploring insights on the political, social, and legislative trends behind these numbers.

It found that nearly all countries have local organisations or governments committed to increasing the number of women serving on company boards.

While these private and public sector efforts demonstrate steps toward achieving parity, the pace of collective progress needs to pick up.

People often ask why the 30% Club is not the 50% Club given that our aim is parity. I think this report answers that question, we are still far from the 30% tipping point in many geographies

Key higlights from the report include:

Globally, only one in five board seats are held by women

A smaller group of women are taking on a large number of board seats – referred to as the ‘Stretch Factor’

Report reveals a disconnect between women holding roles on boards and in the executive.

Globally, only 6.7% of board chairs are women, and even fewer CEOs – 5% – are women

A global average of 19.7% of board seats are held by women, an increase of 2.8% since 2018 compared to a 1.9% increase in the period from 2016 to 2018

Companies with women CEOs have significantly more balanced boards than those with male CEOs: 33.5% vs 19.4%

Only three in 10 board seats held by women in UK behind leaders France, Norway and Italy in boardroom diversity

However, UK enters into top 10 global ranking and could reach boardroom gender parity by 2027.

Commenting on the report, which includes commentary from 30% Club chapters, global chair Ann Cairns said: “With the FTSE 100 on the brink of attaining 40% women in board roles, I am encouraged by Deloitte Global’s finding that UK parity could be reached by 2027.

“People often ask why the 30% Club is not the 50% Club given that our aim is parity. I think this report answers that question, we are still far from the 30% tipping point in many geographies.”

She added: “One of the report’s most interesting findings is the real balance that female leaders bring. If women CEOs can have more balanced boards, there’s no reason that male CEOs can’t.

“Finally, on the stretch, this speaks to the fact that women have a harder time being appointed if they don’t have previous board experience. Chairs and CEOs should be encouraged to give women their first board seat.

“There is plenty of talent out there who would make great directors. This is very true for people of colour too, many of whom would welcome the chance to make a significant contribution at the top of the corporate world but remain significantly under-represented.”

Sharon Thorne, Deloitte Global Board Chair and member of the 30% Club, said: “While it’s heartening to see that the world continues to make progress towards achieving gender parity, with the exception of a few countries, overall progress remains slow and uneven.

“The pandemic has further challenged progress in achieving equality, making it even more important to move past discussion and take concrete actions to ensure inclusion within and beyond the boardroom including gender, ethnic and racial diversity among other characteristics.”

She adds: “Increasing the number of women on boards is only the first step on a larger journey.”

Where we are

The 30% Club has come a long way from when it was set up in the UK in 2010.We now span six continents and more than 20 countries. We’re actively expanding into more G20 countries

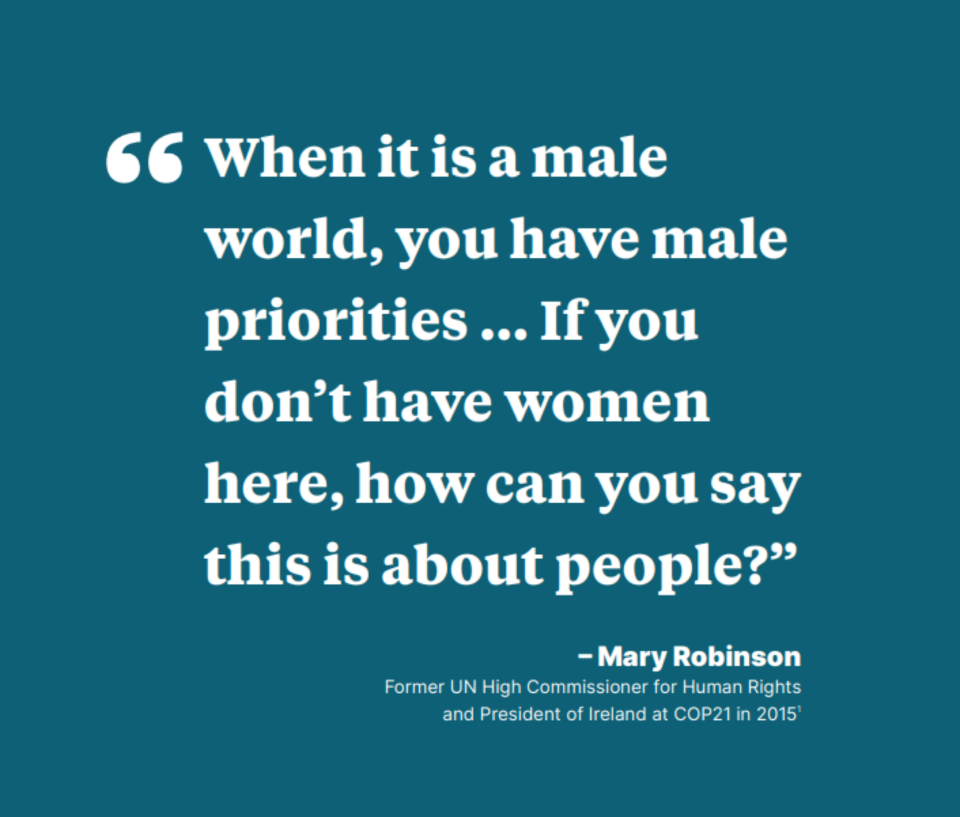

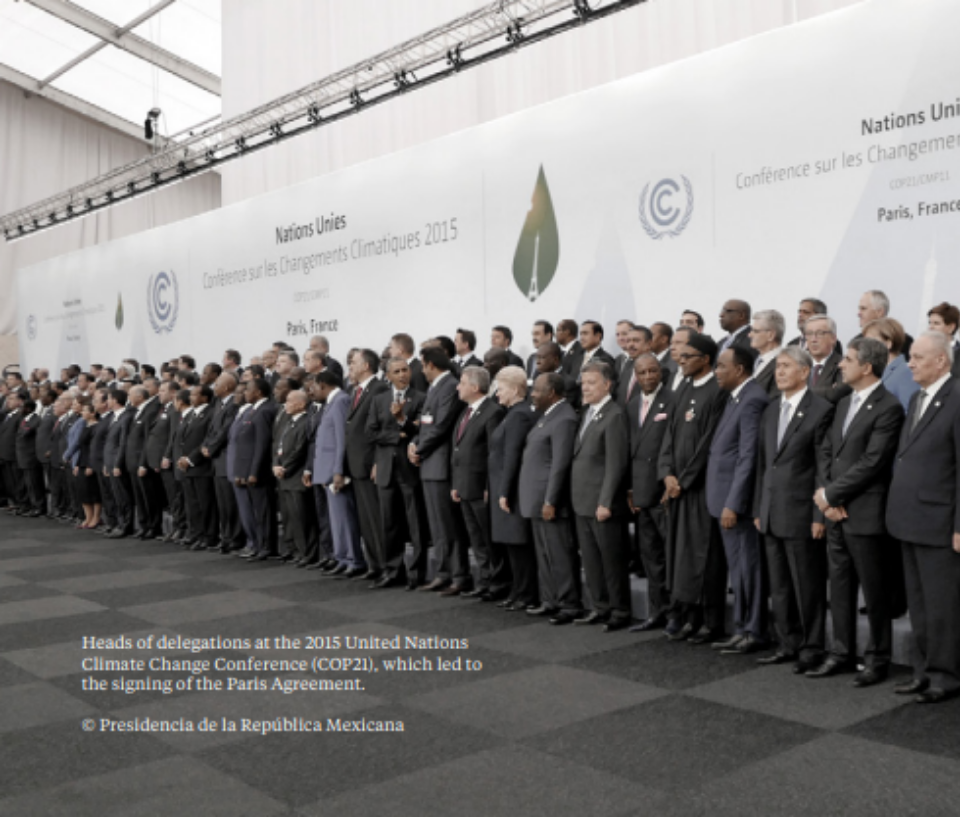

Women are the most likely changemakers for climate action

Stronger together

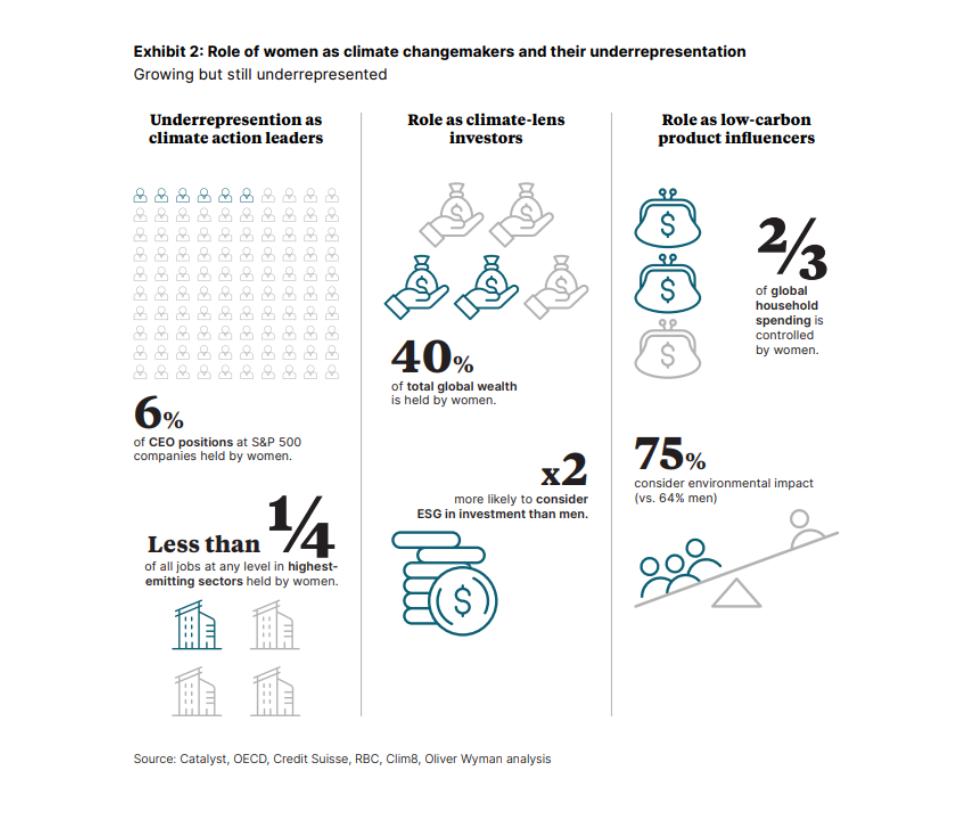

Diversity and climate are top priorities for CEOs and boards of directors, but almost none have considered how linking the two management priorities could accelerate their transition to net‑zero emissions.

As the Oliver Wyman Forum and the 30% Club prepared for COP26 in Glasgow, we set out to uncover what can be achieved when diversity, and specifically gender representation, is included in companies’ climate change plans.

The question was more difficult to answer than we had anticipated. For example, starting with large data sets, we looked at how corporate diversity and climate outcomes might be correlated. Relationships were positive but statistically weak. However, with so many factors at play, we felt that focusing solely on these high‑level numbers was a red herring.

As our research and interviews with more than 20 companies progressed, it became clear that not only are women often excluded from many high-level government and corporate discussions on climate, their role as climate-action changemakers is largely unrecognized and underestimated.

Yet businesses need to include female colleagues, customers, and investors if they are serious about meeting net-zero carbon emissions by 2050.

We consider this report as just the beginning of research on what can be achieved if a greater mix of people — including women — is more explicitly included in companies’ attempts to reach net-zero emissions.

This report talks about action from corporations deliberately. Clearly, this must be taken together with action from governments, the third sector, civil society, and beyond.

We are grateful for your understanding over this report’s limitations — for example, our focus on women in Western countries and a binary view of gender that is not inclusive of all identities and experiences.

We recognize that we do not cover intersectionality or other dimensions of difference, such as race and ethnicity, primarily due to a lack of data.

Despite this, we felt it important to continue and hope the report will have some impact in driving greater awareness and understanding of the critical linkages between these issues.

We thank and are grateful to the many colleagues who were willing to share their expertise and the companies we interviewed. We hope you find our initial research helpful as you consider your transition plans and look forward to continuing the conversation and research.

Rupal Kantaria

Partner, Oliver Wyman Forum

Ann Cairns

Global Chair, 30% Club and Executive Vice Chair, Mastercard

Where we are

The 30% Club has come a long way from when it was set up in the UK in 2010.We now span six continents and more than 20 countries. We’re actively expanding into more G20 countries

PM launches ‘30% Club’ in bid to triple number of women on boards

KUALA LUMPUR, May 8 — Datuk Seri Najib Razak launched today the Malaysian chapter of the “30% Club” to help the country achieve its target of tripling the percentage of women on companies’ boards to 30 per cent by 2016.

Najib said Malaysia is currently lagging behind its target of having more women represented on the boards of public companies.

“But on this we are currently behind target. The figure is only 16 per cent at present for public company boards; and for listed boards, the percentage is even smaller, at 10.3 per cent.

“So I urge the leaders amongst you to do more, to take the next step, to break those glass ceilings and install women on your boards,” he said at the launch, which saw the attendance of senior civil servants and corporate captains.

To help achieve this, Najib announced a new policy where government-linked companies (GLCs) will allow their executives to serve on the boards of other listed companies, also encouraging all listed firms to use the same policy.

In the future, listed companies will also need to disclose the composition and diversity of their boards and top management in terms of gender, ethnicity and age, he said.

Beyond board positions, Najib said Malaysia is on track to achieving its 30 per cent target of women in top management, noting that a joint survey by Talent Corp and PWC last year found that women now make up 24 per cent of such positions in public listed firms.

He noted that the government itself had already hit its target of 30 per cent for women in decision-making positions or those with grade Jusa C and above.

Earlier, Minister in the Prime Minister’s Department Datuk Seri Idris Jala said that as of the first quarter of 2015, women account for 10.3 per cent of board positions in companies, up from 10.2 per cent and 8.6 per cent in 2014 and 2013 respectively.

In the 10th Malaysia Plan, targets were set for Malaysia to increase the number of women in key decision-making positions on company boards to 30 per cent and to boost female participation in the workforce to 55 per cent by 2016.

Today, Najib said that Malaysia was on track to hitting its targeted female labour force participation rate, noting that it had gone up from 46 per cent in 2009 to 53.6 per cent last year.

This meant that around 600,000 women joined the workforce last year and the generation of an extra 0.3 per cent of the GDP growth each year, Najib said.

Acknowledging that he had set Olympic-like targets for women participation on boards, Najib said it was achievable, citing the UK experience where it nearly doubled the percentage of women on the boards of the top 100 Financial Times Stock Exchange from 12.5 per cent in 2011 to 23.5 per cent in 2015.

Najib also addressed scepticism about putting women in top decision-making positions, stating that it was not mere altruism but makes firm business sense, citing a 2007 Mckinsey study that showed such firms performing better than those without women on their boards.

The “30% Club” was started in the UK in 2010 to encourage women representation in company boards. The Malaysian chapter is the seventh, following suit after Ireland, US, South Africa, Hong Kong, and Australia. Source: Malay Mail