Taoiseach Simon Harris joins 30% Club Ireland

The new Irish Taoiseach Simon Harris joined the 30% Club Ireland’s 10th Chair and CEO conference in Dublin today.

Demonstrating his commitment to gender equality in business leadership, Simon showed up as a male ally to our cause.

He joined a large gathering of CEOs and chairs from 30% Club Ireland’s member companies, who represent over 650,000 employees across Ireland. These include both the private, publicly listed, and public service sectors.

The 30% Club is a global campaign supported by Board Chairs and CEOs of medium and large organisations, committed to achieving better gender balance at leadership levels and throughout their organisations, for better business outcomes.

Since it was established in Ireland ten years ago , the gender balance on Irish listed boards (ISEQ20) has more than trebled – from 12.5% then, to 40% today.

Gender Power Gap

One of this year’s themes looks at how companies can address the gender power gap that still exists within many Irish businesses and organisation. This is defined as the proportional power held by women in leadership and management positions, relative to men, which is often defined by historical stereotypes, with human resources as an example. The measurement differs from gender diversity, which only measures the presence of women at the top table, and the gender pay gap, which measures the average difference in remuneration.

As an example, only 25.7% of CFO roles are currently held by women, and this has decreased from 29.7% in 2019, CSO data shows. With CFO roles as important talent pipeline for Chair and CEO roles, addressing this imbalance becomes critical in modern succession planning. Achieving gender power balance is one of the topics that will be discussed by two panels, which will mark the successful progress across Irish business in the 10 years to date and consider where to next.

Panellists include: Myles O’Grady, Bank of Ireland chief executive; Eamonn Sinnott, Interim Head, Intel, Magdeburg, Germany; Carol Andrews, Co-chair Balance for Better Business; Lorna Conn, Cpl chief executive; Hanneke Smits Global Chair 30% Club and Global Head of Investment Management, BNY Mellon, Paddy Hayes, ESB chief executive and Michael Jackson, Managing Partner, Matheson.

Taoiseach Simon Harris told the audience of almost 300 that all women and men in Ireland should have equal access to opportunity, and that Ireland can be exemplary leaders in achieving full gender balance on boards and senior leadership teams, where our publicly listed companies have already exceeded the 33% quota set by the EU Women on Boards directive.

“I’m delighted to join leaders from across the private and public sector to support the important work of the 30% Club. Ireland has a huge pool of talent, and experience, so there is no reason why we cannot ensure boards and senior teams are gender balanced,” he said.

“The Ireland we live in must be reflected across business and wider society, because decisions that can embrace a wide spectrum of viewpoints will be the most informed ones. We have made significant progress to date but there is still a long way to go. I urge all business leaders to embrace gender balance, along with diversity and inclusion. It makes business stronger

Meliosa O’Caoimh, Outgoing Chair of 30% Club Ireland and Northern Trust Ireland Country Head, said what was important from her perspective is continuing the focus on all women.

“Gender is a majority not a minority issue, and a clear focus is still needed. This includes encouraging next generation talent and putting a particular focus on incorporating a regional view in our work. What has been achieved over the last decade in Ireland is fantastic, but we know there is still more to be done to maintain, and advance momentum, for better business outcomes.”

International trends and the likely challenges and hurdles of the next 10 years were also debated, along with examining where the future CEOs and Board chairs will come from, and how the power gap can be collectively closed. The panels also commented on the need to embed progress in every organisation, and not just rely on averages as a strong indicator. This is important in Ireland where CSO data shows that while we make progress on an average basis, 21% of C-suite teams still operate on an all-male basis.

Paula Neary, incoming 30% Club Ireland Chair and a Senior Managing Director at Accenture, said her focus in the new role will be on how we “can use this moment as we redefine new flexible workplaces and new workforces augmented by AI, on changing the system, rather than the people”, and an

‘all gender’ agenda – versus a female agenda – that emphasises new ways of working that support men and women equally, to flourish and progress in modern careers.

“I am honoured and delighted to take over as chair of such an important initiative, which I have supported – and been part of – since its inception.

“If we are going to successfully drive and initiate more progress in this area, we need to look through a wider diverse lens, across society. That means thinking about how we engage everyone – especially younger men in the conversation on changing culture, behaviours and attitudes. Such a focus leads to better workplace outcomes for all talent – in terms of attraction and retention – and is critical to the economic success across Ireland.”

Green shoots of change in Australian boardrooms

In an increasingly complex environment post the global pandemic, boards are facing into new and interconnected landscapes.

There is the suite of digital trends, including AI, robotics and cyber security, more exacting customer expectations enabled by new digital fluencies, workforce transformations underpinned by hybrid ways of working, and the demand for reskilling and greater regulatory scrutiny.

This new reality prompted the 30%+ Club Australia and Deloitte Australia to investigate whether boards are future fit to manage risks and seize opportunities.

Having interviewed board members, executive search firms and investors, they challenged boards to consider complementing the traditional skillsets of governance, law and finance through the additional appointment of directors with diverse professional expertise in digital, marketing/customer and human capital.

Read the full report to find out more about Australia’s progress toward diversity in business leadership and 30% Club Australia’s work here.

Where we are

The 30% Club has come a long way from when it was set up in the UK in 2010.We now span six continents and more than 20 countries. We’re actively expanding into more G20 countries

Gender gap widens across OECD to 13.5%

It will take over 50 years to close the gender pay gap across the OECD! That’s the finding of PwC‘s latest Women in Work report.

The average gender pay gap across the OECD stood at 13.5% in 2022, having widened from 13.2% in 2021.

Luxembourg tops the index with a gap of -0.2%.

Australia demonstrated the best annual improvement, closing its gap by four percentage points to 9.9% and moving up to 10th place in the index.

The UK reported the largest slide of any OECD country, dropping from 13th place in on the index in 2021 to 17th in 2022 with a gap of 114.5%.

Read the full report here.

Where we are

The 30% Club has come a long way from when it was set up in the UK in 2010.We now span six continents and more than 20 countries. We’re actively expanding into more G20 countries

UK FTSE 100 reach 30% women on ExCos

The UK’s top 100 ranked companies have reached the critical mass of 30% women in executive committees for the first time.

The FTSE Women Leaders Review has also confirmed women hold 35% of all leadership roles in FTSE 350 companies and 42% of board seats.

However, despite much welcomed progress for female representation, there remains an absence of women leading the UK’s largest organisations. And almost half of all available appointments now need to go to a woman to meet the Review’s 40% Women in Leadership target by the end of 2025.

Pavita Cooper, UK Chair of the 30% Club, said: “Organisations need to double down on efforts to accelerate the progression of women through the pipeline. CEOs and Chairs need to drive the focus on closing this gap, failing to do so is simply bad for business.”

Read the full report here.

Where we are

The 30% Club has come a long way from when it was set up in the UK in 2010.We now span six continents and more than 20 countries. We’re actively expanding into more G20 countries

Australia’s top 20 companies hit 40% women on board

Australia’s top 20 ranked companies made history this quarter (Q2 2023) achieving an aggregate 40 per cent women on their boards.

This success reflects the long-term efforts of chairs, boards, regulators, investors, executive search firms and campaigns like the 30% Club Australia that have ensured continued stakeholder scrutiny of appointments to listed boards.

Of course, the aggregate figures do not tell the whole story. Across the 759 directorships currently held by women in the ASX 300, an overwhelming number are non-executive directors (685) while just 37 are executive or managing directors including CEOs, and only 37 are chairs.

Read the full report to find out more about Australia’s progress toward gender equality in business leadership and 30% Club Australia’s work here.

Where we are

The 30% Club has come a long way from when it was set up in the UK in 2010.We now span six continents and more than 20 countries. We’re actively expanding into more G20 countries

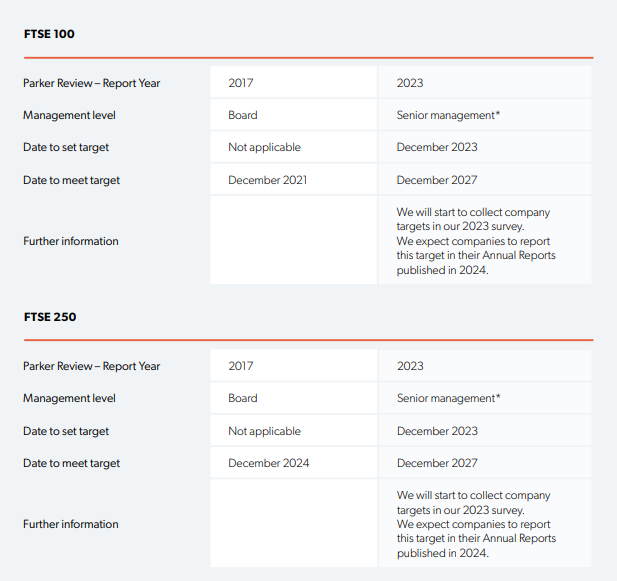

Gender balance almost achieved for ethnic minority directors

Across the FTSE 350, the numbers of ethnic minority directors are currently balanced almost equally between men and women, with 48% being women (47% in the FTSE 100, 48% in the FTSE 250).

The data emerged today from the latest update on the Parker Review – the business-led, UK government backed initiative that sets voluntary race equity targets for Britain PLC.

The 30% Club is proud to support the Parker Review with our own targets for the FTSE 350 to have at least one ethnic minority director or member of the executive committee by the end of 2023 and for half of those newly created seats to go to women of colour.

Today’s update also confirmed that 96 of the FTSE 100 had at least one ethnic minority director by the end of December 2022, up from 47% in 2016 and largely meeting the Parker Review’s initial target for Britain’s biggest companies.

Of course, a single ethnic minority director is just the start of the change we need to see and so it was encouraging to see that half of those FTSE 100 companies actually had more than one ethnic minority director by the end of last year.

But as we have seen in the gender diversity space, there is still so much to be done if true equity is to be achieved.

It remains the case that the vast majority of ethnic minority directors occupy non-executive roles. In the FTSE 100, for example, while the data revealed ethnic minority directors now account for 18% of all directorships, just six ethnic minority directors held a chair position, only seven were CEOs and nine were CFOs.

However, there are many practical things company leaders can do to bring about change from collecting more and better data to taking part in reverse mentoring.

For example, the 30% Club is helping organisations build on their commitment to race equity with our Leaders for Race Equity programme, run in partnership with the CBI’s Change the Race Ratio and Moving Ahead.

We match CEOs with ethnic minority executives from outside their organisations to learn from each other’s experiences and challenges while also attending working groups with their HR and D&I leads on topics ranging from data to AI to inform and improve corporate action on race equity.

The Parker Review has set new targets for December 2027:

- – Each FTSE 350 company will be asked to set a percentage target for senior management positions that will be occupied by ethnic minority executives in December 2027

- – 50 of the UK’s largest private companies have been set the target of having at least one ethnic minority director on the main board by December 2027.

- – Each company will also be asked to set a target for the percentage of ethnic minority executives within its senior management team

You can read more about the targets and access the rest of the Parker Review data by clicking the box below.

Where we are

The 30% Club has come a long way from when it was set up in the UK in 2010.We now span six continents and more than 20 countries. We’re actively expanding into more G20 countries

Gender-balanced boards more likely to push for better company culture

What diversity delivers

The 30% Club, in partnership with board advisory specialists Lintstock, has today issued new qualitative analysis based on the engagement of male and female directors in 100 FTSE board reviews in a report titled Evidencing the Contribution of Gender Balance to Board Effectiveness.

The survey showcases the difference gender diversity makes to the running of corporate boards, with a significant finding that women are more likely than men to focus on emerging issues, notably company culture and employee development.

In addition, female directors were also more likely to offer criticism and recommendations for improvement on both their own performance and their business activities.

The past twenty years have irrevocably changed the way businesses think about board composition and the impact this has on decision-making, with a push for greater gender diversity at the forefront of this shift in perception.

Through examining the engagement of male and female directors in board reviews, this study illustrates how gender diversity contributes positively to board performance. The findings show that gender balance is no longer a question of fairness, but that of effectiveness.

Despite the increased focus on ethnic diversity, the analysis highlights there have yet to be any examples of boards truly grappling with diversity in its wider forms, with some mismatches occurring between diversity ambitions and boards’ actions.

By demonstrating the link between diversity and effective oversight, we hope that this study will renew the impetus of boards to go beyond the traditional candidate pool, to secure directors with a broader set of skills and backgrounds.

Other key findings…

- – Female directors are more likely to identify the need for further board diversity in areas such as age, culture and social background

- – Women are three times more likely to recommend greater ethnic diversity than their male colleagues

- – Women engaged heavily on employee sentiment and culture and were over 50% more likely to serve as a designated non-executive director for engaging with the workforce – the most frequently adopted employee engagement mechanism

- – Women were 50% more inclined to raise ESG performance as an area for improvement.

Hanneke Smits, global chair of the 30% Club and CEO of BNY Investment Management, said: “The findings further confirm that a more gender diverse group of board members will consider a greater variety of issues and ask a wider range of questions. Of particular importance in the report is the evidence that female board directors place a greater priority on hiring diverse teams and therefore increasing access to a broader pool of skills and experience.

“Against the backdrop of a challenging macro and geopolitical environment, it’s critical that companies harness the power of diverse talent at all levels of their organisation to succeed. At the 30% Club our focus is unwavering: diversity must remain on the board agenda and there is genuine progress to ensure current, and future, executive leadership teams better represent the society we live in.”

Neil Alderton, a partner at Lintstock, said: “Oversight of employees was becoming a headline concern for boards even before the upheaval of COVID-19 and findings from our study reveals that female board members are more than twice as likely as their male counterparts to identify the need to focus on people development and improving the diversity of the workforce.

“Better gender balance is not only a question of fairness – our findings show that it is also a matter of effectiveness. We see that diversity of gender contributes to diversity of thought around a number of board performance areas, broadening boards’ horizons and bolstering the support and challenge that directors are able to provide as a collective.”

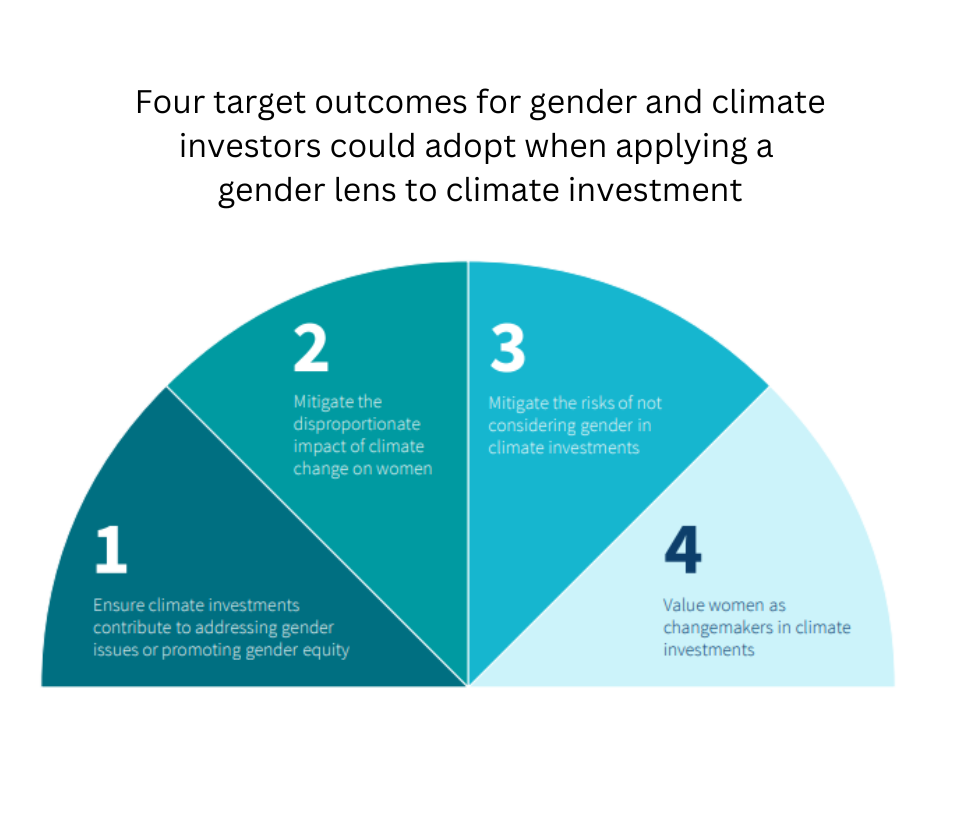

Investors given tool to boost gender equity in net zero race

The Women in Finance Climate Action Group has developed a framework to help financial institutions support women in the net zero transition and limit the negative impact of climate change on women.

The 30% Club is delighted to support the rollout of this first-of-its-kind framework specifically for private investors and the key role they play in financing net zero.

Integrating a gender lens into climate investments is important to value women as key stakeholders in solutions, to ensure not only a better path, a more ‘Just Transition’, but also a shorter one, unleashing the potential of women as changemakers, in finance and in who and what is being financed.

Women remain under-represented in climate finance

The Women in Finance Climate Group argues that whilst climate change disproportionately impacts women, women remain seriously under-represented in climate policy, climate decision-making and climate finance.

The Action Framework, created in collaboration with the Oliver Wyman Forum and 2X Global, is available to download here.

The Women in Finance Climate Action Group comprises women leaders from business, the public sector and civil society and includes Tanya Steele, CEO of WWF-UK and Sarah Breeden, Executive Director at the Bank of England.

Amanda Blanc, Aviva’s Group CEO, said: “Private capital is key to mobilising the trillions of dollars required over the next three decades to limit warming to 1.5 degrees. And yet the global private finance sector does not currently have the tools or incentives in place to evaluate and improve the impact of climate finance on gender equality.

“We need more data to measure the impact of specific climate investments or project financing on women and girls. We hope this Framework will give financial institutions what they need to begin to measure and deliver greater gender equality when taking action on net zero.”

Rupal Kantaria, Partner, Oliver Wyman Forum and head of climate for the 30% Club, added: “This first-of-its-kind Action Framework for investors embeds gender considerations into climate investment decisions. Both are critical for financing a faster and more just climate transition.”

Where we are

The 30% Club has come a long way from when it was set up in the UK in 2010.We now span six continents and more than 20 countries. We’re actively expanding into more G20 countries

More women rising to the top in France across the SBF 120

Paris, 16 January 2023. The 30% Club France Investor Group announces today the publication of its second annual report, revealing the latest trends and data on gender diversity at 120 companies part of the SBF 120 Index in France.

Launched in November 2020 by six French asset managers with the objective to promote better gender diversity within the SBF 120 companies’ executive management teams by 2025, the investor group has today 16 members representing over €6 trillion of assets under management, 5 having joined this year.

Core activity

In its second year of the campaign, the 30% Club France Investor Group conducted a wide variety of activities to engage with corporates, stakeholders, and experts, enabling the Club to develop key observations regarding gender diversity in France:

– Compared to last year, companies are both more open to engaging and more prepared. The refusal to engage is more the exception than the rule. However, the 30% Club France Investor Group faced some refusals under the pretext of “we already have 30% of women on our Executive Committee”, although the goal is to look beyond the percentage of women on that committee.

– Most companies are convinced of the value of gender diversity. A positive momentum has been emerging in the form of action plans and targeted goals. But these targets, as well as their scopes (i.e., the executive body targeted) and time horizons, lack homogeneity, making it difficult to work towards the goal of 30% female representation at the highest levels of management.

– Two opposite trends are coming into play. The COVID-19 crisis had a disproportionately negative impact on women in attracting, retaining, and promoting talent while the enforcement of the Rixain Law (1) acted as an accelerator of awareness for the importance of gender diversity. The issue is more acute in some sectors, particularly industrial and STEM activities, making the competition for attracting female talent more intense. The generalization of remote working may accentuate the recruitment problem for those companies where this will not be possible due to the nature of the jobs.

– Sectors with high female employment rates (i.e. Financial Services and Insurance, Consumers) still have obvious glass ceilings. While there are targets and strategies, these sectors have a long way to go and changed very little compared to last year.

– The notion of gender pay gap was discussed at length. There is some confusion between equal pay gap and gender pay gap. Closing the gender pay gap requires measures to break the glass ceiling through adequate, supportive, and relevant HR policies.

Building on a strong foundation

Continuing the efforts from 2021, the 30% Club France Investor Group collaborated with policymakers and experts seeking to address the secular question of gender diversity.

As chair of the 30% Club France Investor Group for the 2022 engagement season, Marie-Sybille Connan from Allianz Global Investors declares: “the 30% Club France Investor Group has a solid foundation to lead into year three of the group. Our roadmap for 2023 is set and articulated around:

– Moving the needle further and continuing to engage with SBF120 constituents

– Collaborating with Mercer on their Global Talent Trends survey including gender diversity practices to get more consistent and actionable data

– Advocating for the creation of the CEO & Chair pillar to have a complete 30% Club Chapter in France. France is the latest country where an investor group has been established but still needs the CEO & Chair pillar that will be instrumental in driving awareness on gender diversity in the corporate world. We invite any CEO or Chair who wants to act and drive gender equality to reach out to us.”

New leadership structure

In order to ensure proper onboarding and transfer in knowledge among members, the 30% Club France Investor Group is implementing a co-chairing of the initiative over a two-year mandate.

In 2023, Candriam AM will be co-chairing the 30% Club France Investor Group alongside Allianz Global Investor.

Theany Bazet, Co-Chair of the 30% Club France Investor Group and Fund Manager at Candriam, said: “I am honoured to join Marie-Sybille as Co-Chair to continue building bridges with corporations via active engagement and constructive dialogue together with our community of 16 responsible engaged investors.

“It is only by sharing best practices and bringing to light any issues that we can advance gender diversity and drive systemic change.

“We will notably thrive to developing the CEO/Chair pillar of the 30% campaign to have in France a full 30% chapter.

“Doing so will strengthen the commitment of improving gender diversity in the higher ranks of companies and increase the chances of success.”

The full report, including key figures, case studies and the KPIs list, is available here.

ENDS

Notes to editors

[1] On December 24, 2021, France adopted a new law to promote gender equality in the workplace and in the economy at large. This law, referred to as the Loi Rixain (Rixain Law), after the bill’s main sponsor in the French parliament, Marie-Pierre Rixain, imposes quotas for the representation of women in the leadership positions of large corporations, defined as corporations of 1,000 or more employees. By March 1, 2027, at least 30% of managerial positions in these companies, as well as 30% of the seats on these corporations’ governing bodies, will have to be filled by women. By March 1, 2030, these quotas will be raised to 40% for both managerial positions and governing bodies.

About the 30% Club France Investor Group

The 30% Club is a global campaign taking action to increase gender diversity at board and senior management levels. In 2010, the campaign was launched in the UK and it now has chapters around the world, with some backed by dedicated investor groups. In November 2020, six investment institutions decided to create an investor group in France.

The 30% Club France Investor Group now includes 16 members representing around €6 trillion AUM. Its focus is to engage with the investee companies and push for at least 30% of executive committee seats to be filled with women by 2025. It also aims to increase disclosure expectations around the topic of gender diversity. The group believes gender balance on boards and senior management encourages better leadership and governance, diversity and inclusion contribute to all-round board performance and, ultimately, increase corporate performance for companies and their shareholders.

Contacts

Steele & Holt

Servane Taslé

+33 (0)6 66 58 84 28

servane@steeleandholt.com

Anais Miegeville

+33 (0) 6 33 73 85 16

Allianz Global Investors

Marion Leblanc-Wohrer

+33 (0) 1 73 05 77 91 / +33 (0) 6 85 15 74 54

Marion.LeblancWohrer@allianzgi.com

Candriam

Isabelle Lieven

+32 2 509 61 69

media_relations@candriam.com

Brain tumour survivor on why Mission Include mentoring is so important for her

A year ago, commercial banker Jessica Jones underwent a life-saving operation to remove a brain tumour that left her unable to walk unassisted.

Since then, not only has the 38-year-old mum of three from Swansea returned to the job that she loves but she’s also embarking upon a journey of personal development by being mentored on the 30% Club cross-company mentoring programme Mission INCLUDE.

It was important to Jessica to explain this life-changing experience to her mentor at their first meeting in November. Her diagnosis 18 months earlier changed her outlook on life and her career and will be a big part of her mentoring journey.

At its core, Mission INCLUDE is a structured cross-company mentoring programme that expertly pairs senior business leaders with mentors outside of their industry to challenge and help them progress.

Jessica is a relationship director at NatWest with responsibility for financing SMEs with turnovers of up to £50 million. She has been paired with mentor Laura Pingree, a partner at accountancy firm BDO LLP, who specialises in energy and mining.

During their first meeting, Jessica revealed how the excitement of receiving a promotion in March 2020 was overshadowed, three months later, by the devastating news that she would require life-saving surgery.

“I didn’t want sympathy, but I wanted her to know the journey I’d been on and why I was so determined to get the most out of this experience,” she says.

Jessica explained to Laura that after suffering hearing loss, headaches and tinnitus since 2019, she saw her GP in June 2020, who prescribed migraine tablets. But when the symptoms didn’t improve after a couple of days, she was referred to hospital for a CT scan.

While waiting for that appointment, her blood pressure became abnormally high, so she attended Prince Phillip hospital in her hometown of Llanelli, Carmarthenshire. After two days of tests – and while sat alone due to Covid restrictions – Jessica was given the devastating news that she had an acoustic neuroma causing pressure on her brain stem.

“I was in total shock. Hearing those words, ‘you’ve got a brain tumour’ was terrifying. I was absolutely petrified and burst into tears,” says Jessica.

Backlogs caused by the pandemic meant she had to wait until January 2021 for surgery.

During a gruelling 13-hour operation, which involved removing a section of skull from behind Jessica’s ear, surgeons successfully removed most of the tumour. They advised to leave a small part of the tumour which had grown around the facial nerve, so not to cause facial palsy. The procedure has left her with single sided deafness and a CROS hearing aid.

She was kept in hospital for two weeks. Covid restrictions meant that Jessica’s husband Mark and their daughters Ella who is eight, and five-year-old twins Emily and Lily, couldn’t visit her.

“I was unable to stand the first few days without vomiting due to the vertigo, and each day challenged myself a little more. Thanks to the support of the team there, I finally left the hospital trundling along on a Zimmer frame at the age of 37,” she says. “When I was home, I paid for weekly sessions with a neuro-physio who helped me build the confidence and strength to walk without the frame.”

Her diagnosis left her fatigued and sometimes unable to walk more than 2,000 steps a day, but in September 2021, Jessica was keen to return to the job that she loves.

“Natwest has fully supported me since the moment I was diagnosed and on the path towards rehabilitation,” says Jessica. “We spoke about both my personal and career development and I explained that I thought that being mentored by someone outside of banking would help develop me as an individual. They recognised what I had been through – and the journey that still lies ahead – and I’m grateful they gave me special approval to take part in Mission INCLUDE.

“In the 14 years I’ve worked for NatWest, I’d previously been on excellent courses that were bank focused and I have always been very passionate and committed in taking responsibility for my career progression. I knew that I would benefit from having an outside mentor challenge me, hold me accountable and offer external perspective on my development.”

Jessica admits she was initially surprised by who she was paired with.

“When I first read Laura’s profile, I was unsure as to why we’d been put together as our experience looks so different on paper. But I soon realised we are so well matched. Our personalities are very, very different but whatever algorithms Moving Ahead use to match people, it definitely works!

“We are very open with each other about our lives and our experiences. You need that openness, otherwise the mentoring would be very scripted.”

At their most recent meeting in January, Laura challenged Jessica to apply to sit on a non-executive board during the nine-month programme – something that would help give her exposure to other business issues that could be of use to her in NatWest.

In preparation, she’s also been tasked with gathering 360° feedback from colleagues to see if the areas that Jessica thinks that she needs to develop align with those they suggest.

“I questioned who would want me on their board, but by sharing her own experiences, Laura was able to reassure me that I have transferable skills and that businesses in sectors outside of banking – and outside of my comfort zone – would welcome,” she says. “And I now realise the experience would greatly aid me in my development within NatWest.”

Aside from the one-to-one mentoring, Mission INCLUDE offers other benefits.

“The programme includes regular Zoom events with participants from around the world, masterclasses to get the best out your development, networking sessions with other mentees, and the opportunity to hear from fantastic, thought-provoking expert speakers,” she says.

A recent talk by coach Holiday Phillips on pushing yourself outside of your comfort zone resonated with her.

“On Christmas Eve, I received the news that the remainder of my tumour is stable and I’ll have yearly scans to monitor what is left of it,” she says. “Having the tumour has taught me is life is too short to be taken for granted and to keep pushing yourself, developing and reflecting. Sometimes that means doing things that you’re a little uncomfortable with, but you may never get the opportunity to do again if you don’t do them now. I want to push myself and do things that perhaps make me feel a little bit uncomfortable.”

Jessica can already see the benefits that the Mission INCLUDE programme will bring to her and NatWest.

“I am already learning lots that I can apply to my current role and future development. Having a mentor share their expertise and encouragement will also help equip me with new skills that I can bring to the bank to assist others,” she says.

And it’s not only at the bank that that Jessica wants to help others. Last month, she embarked on an ambitious 10,000 Steps a Day challenge to fundraise and raise awareness for Brain Tumour Research to help find a cure for the devastating disease as a way of thanking all those who helped her. She raised more than £2,500. If you would like to donate, click here for more information.

Where we are

The 30% Club has come a long way from when it was set up in the UK in 2010.We now span six continents and more than 20 countries. We’re actively expanding into more G20 countries

30% Club UK marks their 15th anniversary at the London Stock Exchange Market Open

On 25th March 2025, the 30% Club UK marked its 15-year anniversary with a special Market Open ceremony at the London Stock Exchange Group – an occasion to reflect on the progress made in gender diversity in corporate leadership, and to renew our commitment to accelerating change.

When the 30% Club launched in 2010, women held just 12.5% of FTSE 100 board seats. Today, that figure stands at 44.7% – a milestone that demonstrates the power of collective action and sustained advocacy. This shift has not happened by accident; it is the result of a relentless, coordinated effort by businesses, investors and policymakers to challenge outdated norms and drive real, structural change.

While there is much to celebrate, there is also much more to do. Women still make up just 9% of FTSE 100 CEOs and as Pavita Cooper, Chair of the UK 30% Club pointed out at the event “The pace of change at the CEO level remains glacial.”

A Business Imperative, Not Just a Moral One

The Market Open brought together influential leaders committed to building more inclusive leadership teams. Pavita Cooper was joined by Adam Crozier, Chair of BT, who reflected on the progress made and the challenges that remain. Don Robert, Chair of LSEG, closed the speeches with a powerful call to action – reminding us that gender balance in leadership is not just the right thing to do, but a business imperative.

Building on 15 Years of Momentum

The 30% Club’s journey over the past 15 years has demonstrated that change is possible – but only when organisations actively commit to it. Board representation targets, transparent reporting and leadership development programmes have all played a role in shifting the dial. However, closing the gender gap at the CEO level and within executive teams will require even more intentional action.

This includes:

Strengthening the pipeline: Ensuring more women move into profit and loss (P&L) roles, which are often stepping stones to CEO positions.

Challenging outdated succession planning: Encouraging boards to look beyond traditional networks when selecting future leaders.

Holding organisations accountable: Continuing to measure and report on gender diversity progress, not just at board level but across senior leadership teams.

With global challenges reshaping the business landscape, now is the time to double down on inclusive leadership.

We are immensely grateful to the London Stock Exchange Group for hosting this event and to all our members, partners, and supporters who continue to champion this cause. The last 15 years have shown what’s possible. Now, we must accelerate progress and ensure the next generation of leaders operate in a business world that values talent above all else.

Narzędziownik DEIB: pierwszy w polsce przewodnik po zasadach tworzenia polityk różnorodności, równych szans, włączenia i przynależności w firmach

W jaki sposób stworzyć miejsce pracy, w którym różnorodność, równe szanse, włączenie i przynależność stają się codziennością? Pomóc ma w tym publicznie i bezpłatnie dostępny Narzędziownik DEIB (z ang. Diversity, Equity, Inclusion & Belonging) – pierwszy tak kompleksowy przewodnik poświęcony tworzeniu polityk wspierających budowanie kultury organizacyjnej opartej na zasadach różnorodności, równych szans, włączenia oraz poczucia przynależności w spółkach. Publikacja dostarcza fachowej wiedzy oraz praktycznych wskazówek jak opracować i skutecznie wdrażać polityki DEIB, m.in. szczegółowy opis czterech faz ich implementacji oraz odrębnych polityk DEIB dla zarządów i rad nadzorczych oraz osób pracujących.

Opracowany przez 30% Club Poland Narzędziownik DEIB jest efektem wieloletnich doświadczeń, analiz i współpracy z ekspertami/ekspertkami oraz praktykami/praktyczkami biznesu i prawa. Patronami publikacji są (w kolejności alfabetycznej): Akademia Przywództwa Henryki Bochniarz, Divercity+, Forum Odpowiedzialnego Biznesu, Fundacja Kobiety Inspirują, Karta Różnorodności, UN Global Compact Network Poland oraz Stowarzyszenie Klub Akademii Liderek.

KOMPLEKSOWE ŹRÓDŁO INSPIRACJI I KREATYWNOŚCI

Narzędziownik DEIB, oparty na doświadczeniach współpracujących z 30% Club Poland ekspertów i ekspertek, zawiera zasady, akty prawne, sugestie, pomysły oraz rekomendacje, które pomagają krok po kroku wdrożyć polityki DEIB w organizacji. Narzędziownik nie jest poradą prawną ani konsultingową, a jedynie kompleksowym poradnikiem mającym służyć jako źródło inspiracji i kreatywności – z wielu dostępnych podejść i rozwiązań, 30% Club Poland zachęca do wyboru tych, które najbardziej odpowiadają możliwościom danej organizacji.

DEIB to akronim, który wyraża uniwersalne wartości, takie jak szacunek do drugiego człowieka i zapewnienie równych szans. Na tych fundamentach powstał Narzędziownik do wdrażania polityk DEIB – praktyczne i kompleksowe opracowanie wspierające firmy w tworzeniu bardziej włączających i przyjaznych miejsc pracy. To nie tylko zbiór dobrych praktyk z kraju i zagranicy, ale także efekt wieloletnich doświadczeń, analiz i obserwacji, które pozwoliły nam dostrzec, jak wiele jeszcze możemy zrobić, by tworzyć bardziej otwarte i włączające kultury organizacyjne. Wspólnie z gronem wybitnych ekspertów i ekspertek oraz instytucji od lat aktywnie wspierających różnorodność, stworzyliśmy narzędzie, które ma na celu realne wsparcie dla firm w budowaniu kultury szacunku i poczucia przynależności w miejscu pracy

DŁUGOFALOWY PROCES W CZTERECH FAZACH

Wychodząc naprzeciw potrzebom spółek, które chcą stać się bardziej różnorodne i włączające, lecz nie wiedzą, od czego zacząć, autorzy raportu podzielili proces wdrażania DEIB na cztery szczegółowo opisane fazy: przygotowanie do wdrożenia polityk DEIB w spółce, opracowanie polityk DEIB (warto stworzyć dwie odrębne polityki: dla władz spółki oraz dla osób pracujących), realizację polityk DEIB oraz rozwój kultury organizacyjnej opartej na zasadach DEIB. W Narzędziowniku DEIB poruszono również kwestie przywództwa oraz mierzenia się z procesem zarządzania zmianą i przekonywania do niej nie tylko współpracowników, ale także osób decyzyjnych.

Polityki DEIB powinny być konkretne i dostosowane do możliwości firmy, oparte na rzetelnie zabranych przez firmy danych i na wynikach badań wśród pracowników, tak aby uwzględniały każdy głos w organizacji. Warto zaangażować w ich opracowanie wewnętrzny zespół roboczy składający się z osób o zróżnicowanym doświadczeniu i kompetencjach. Najskuteczniejszym podejściem jest wyznaczenie mierzalnych celów z horyzontem realizacji do osiągnięcia zarówno przez władze firm jak i pozostałych pracowników, z uwzględnieniem odmiennej specyfiki tych grup. Kluczową rolę odgrywa również odpowiednia komunikacja: jasna, przejrzysta i regularna. Istotne jest także stworzenie w organizacji koalicji na rzecz DEIB, która wesprze jego wdrożenie. Należy pamiętać, że to proces długofalowy, wymagający konsekwentnego i przemyślanego działania

KORZYŚCI PŁYNĄCE Z RÓŻNORODNOŚCI

Jak potwierdzają badania prowadzone od II połowy XX wieku, aby korzyści z różnorodnej perspektywy i doświadczeń przekładały się na decyzje, potrzebna jest tzw. masa krytyczna, czyli udział mniejszości na poziomie przynajmniej 30%. Tymczasem z najnowszych badań 30% Club Poland dotyczących 140 największych spółek GPW wynika, że na koniec 2024 r. było jedynie 27 firm (19% wszystkich badanych), w których udziały kobiet we władzach spełniały to kryterium. Nadal w niemal co piątej spółce kobiety nie były reprezentowane we władzach, a jednie w 4,3% firm na czele stały prezeski. Z 18,4% udziału kobiet we władzach spółek z WIG140 na koniec 2024 roku do 30% jeszcze daleka droga.

Różnorodność jest faktem. Pytanie brzmi: co z nią zrobimy? Czy będziemy rozwijać naszą organizację tworząc inkluzywne środowisko pracy, dbając o równość szans i poczucie przynależności - czerpiąc z różnorodności płci, wieku, perspektyw, by rosnąć w zrównoważony i odpowiedzialny sposób? Bo kolejne fakty są takie: troska o dobrostan i zdrowie psychiczne pracowników, przeciwdziałanie dyskryminacji, szacunek dla różnorodności, to dziś kluczowe oczekiwania wobec pracodawców. I tym razem liczy się autentyczność, a nie puste deklaracje. Narzędziownik DEIB pomoże nam o to zadbać, gdy usłyszymy “sprawdzam”

Pobierz Narzędziownik DEIB

Sugestie, pomysły oraz case studies, które 30% Club Poland mógłby wykorzystać w kolejnych publikacjach można przesyłać na adres: poland@30percentclub.org

Jennifer Barker named Global Chair of 30% Club

LONDON, March 6, 2025 –- 30% Club, a business-led campaign to boost female representation at the board and C-Suite level in the world’s biggest companies, has announced the appointment of Jennifer Barker, Global Head of Treasury Services and Depositary Receipts at BNY, as its fifth Global Chair.

Jennifer brings a wealth of financial services experience and was recently named as one of ‘The Most Powerful Women in Banking’ by American Banker. In addition to her responsibilities spearheading BNY’s Treasury Services and Depositary Receipts businesses, Jennifer is a member of the BNY Executive Committee. Jennifer serves on the Ross School of Business Advisory Board, the board of Physicians for Peace and is a member of the Dallas Chamber of Commerce’s Executive Women’s Roundtable.

At BNY, Jennifer previously served as the Executive Sponsor for WIN, the company’s employee resource group supporting the retention and advancement of women, and today proudly serves as the Executive Sponsor for VETNET, BNY’s employee resource group supporting veterans, military spouses, family members and their colleagues.

“I’m delighted to take on this role as Global Chair of 30% Club,” said Jennifer Barker, Global Head of Treasury Services and Depositary Receipts at BNY. “I firmly believe an environment where all people can fully contribute, be themselves, and share their unique perspectives, ultimately leads to better commercial outcomes. That’s why I’m committed to advancing the campaign’s goal of encouraging CEOs and Chairs to strengthen every stage of their talent pipeline and cultivate the conditions for future leaders to not only thrive but progress into senior, decision-making positions.”

Jennifer succeeds Hanneke Smits, who assumed the role of Global Chair in February 2023. Under Hanneke’s leadership, 30% Club evolved its mission to ensure that businesses target diversity beyond the boardroom and in the C-suite. Hanneke, who retired as Chair of BNY Investments at the end of 2024, will continue to champion the campaign’s ambitions as a Global Ambassador.

“It has been a true privilege to serve as Global Chair,” added Hanneke. “I remain a fervent advocate of 30% Club’s strategic goals, and I’m excited to see what the campaign achieves next.”

Today, the 30% Club campaign’s global members include more than 1,000 board chairs and CEOs from 20 markets spanning across 6 continents.

Media contacts

30% Club

Mary Strange mary@30percentclub.org

Gay Collins gaycollins@montfort.london

Simone Selzer sselzer@brunswickgroup.com

BNY

Anneliese Diedrichs anneliese.diedrichs@bny.com

Saurav Karia Saurav.karia@bny.com

About 30% Club

The 30% Club is a global campaign led by Chairs and CEOs taking action to increase gender diversity at board and senior management levels of the world’s biggest companies. We set targets of a minimum of 30% female representation at the board and executive committee levels. This is the critical mass at which research shows minority voices are heard. However, the goal is parity.

The campaign’s international footprint unites more than 20 countries around the world, from Australia and Japan to Mexico, the US and Canada. We support diversity in its very broadest sense and while gender has been our starting point, we fully realise that considerations of ethnicity, disability, sexual orientation, socioeconomic background and beyond are all part of the journey – and that gender identities are themselves evolving rapidly. We believe that only those organisations that foster truly inclusive cultures – cultures that embrace women who look, act and, importantly, THINK differently – can reach their full potential to positively impact their people, their markets and their communities.

Integrating Care Supports for Employees is Essential for Retention

A new report launched today by the 30% Club Ireland, supported by Accenture, highlights the economic and workforce benefits of integrating care – childcare, eldercare, and self-care – into corporate policies.

The research highlights the significance of ‘Care Economics’ – the business case for integrating caregiving support into workplace strategy. It quantifies the return on investment of flexible, care-supportive policies, demonstrating how enabling employees to balance their caregiving responsibilities leads to measurable financial gains, including higher retention, increased productivity, and reduced absenteeism. By prioritising such policies, businesses can retain experienced talent while reducing hiring and onboarding costs. Those that fail to adapt risk losing talent in the ever-evolving modern workforce.

Key findings that support the importance of leveraging Care Economics include:

- Almost three in five (57%) employers report higher productivity from their employees after introducing hybrid work and flexible care policies.

- Over a third (35%) of companies see direct commercial benefits from supporting caregiving responsibilities.

- 31% increase in employee retention in organisations that provide eldercare and childcare support.

- 68% reduction in absenteeism in workplaces with structured care policies.

- Three in four (75%) employers say technology has improved employees’ ability to balance work and care responsibilities.

- 71% of employees say work-life balance policies have improved their overall well-being, and those working in organisations with strong policies report 35% lower burnout rates.

The research also highlights shifting employee expectations and priorities:

- 40% of employees say their organisation does not support working parents.

- Over half of employees (52%) believe eldercare is not given the same level of workplace support as childcare.

- 46% say hybrid work has positively impacted their self-care and work-life balance.

- Half (50%) of Gen Z employees prioritise work-life balance over salary, making flexibility and well-being key drivers of retention among younger talent.

- 42% of millennials report that a poor work-life balance is a leading reason for leaving a job.

- 30% of employees aged 50+ feel excluded from flexible work policies, often because of outdated assumptions about their adaptability to remote or hybrid work.

The research, conducted between October 2024 and January 2025 by Reputation Inc, examines the intersection of caregiving responsibilities, work-life balance, and workplace policies. The study combines:

- Quantitative survey data from over 1,300 employees in Ireland working across various industries.

- Qualitative insights from 150 Irish employers, including SMEs, large indigenous businesses, and multinationals.

- Focus groups with Gen Z future leaders, exploring shifting workplace expectations.

The findings provide evidence-based insights into the business impact of caregiving policies, offering practical recommendations for improving retention, engagement, and workforce productivity.

Udział kobiet we władzach spółek z WIG140 – symboliczne zmiany. Pogorszenie wskaźnika wśród blue chipów.

Udział kobiet w zarządach i radach nadzorczych 140 największych spółek notowanych na warszawskiej giełdzie wzrósł w trakcie minionego roku tylko nieznacznie – o 0,4 pp. i na koniec 2024 r. wyniósł 18,4%, wynika z danych 30% Club Poland. Rozczarowujące są przede wszystkim wyniki dla spółek z WIG20, w przypadku których udział kobiet we władzach był o 0,8 pp. niższy niż rok wcześniej i wyniósł 22,1%. Lepsze informacje płyną z giełdowych „średniaków”. W spółkach z mWIG40 udział kobiet wzrósł rdr o 3,5 pp. i wyniósł 22,0%, czyli praktycznie tyle, co w przodujących blue chipach. Najgorzej pod względem różnorodności płci we władzach prezentują się małe spółki. W firmach z sWIG80 udział kobiet we władzach stanowił 14,9% i był o 0,9 pp. gorszy niż rok wcześniej.

Podobnie jak w latach ubiegłych, sektorem o największej różnorodności płci we władzach był sektor finansowy, w którym kobiety stanowiły 25,5% władz. Jednak względem roku poprzedniego finanse zanotowały spadek wskaźnika o 1,8 pp. Kolejne pod względem reprezentacji kobiet były sektory nieruchomości i detal z odpowiednio 21,2-proc. i 21,1-proc. reprezentacją kobiet w zarządach i radach nadzorczych łącznie. Średnio wypadły sektor TMT (18,4%) oraz energetyka i surowce (17,1%). Najgorzej sytuacja wygląda w sektorze rolno-spożywczym (10,3%), przemyśle (13,7%) oraz medycynie (16,7%).

W WIG140 WIĘCEJ SPÓŁEK BEZ KOBIET WE WŁADZACH

Nadal wśród największych spółek giełdowych mamy sporą grupę firm bez kobiet zarówno w zarządzie, jak i radzie nadzorczej. Na koniec 2024 r. było 29 firm (czyli 20,7% spółek z WIG140) w całości z męskimi zarządami i radami nadzorczymi. W latach poprzednich sytuacja wyglądała korzystniej – żadnej kobiety we władzach nie miało 28 firm w 2023 r. oraz 23 w 2022 r.

Na koniec minionego roku około jedna piąta spółek (27) z badanej grupy miała przynajmniej 30-procentowy udział kobiet we władzach. W roku poprzednim takich firm było o dwie więcej. 30% to istotny wskaźnik, ponieważ zgodnie z teorią tzw. masy krytycznej, aby głos mniejszości był słyszalny i miał wpływ na większość, musi ona stanowić właśnie minimum 30%.

SEKTOR FINANSOWY WCIĄŻ LIDEREM RÓŻNORODNOŚCI, LECZ Z GORSZYM WYNIKIEM RDR

Podobnie jak w ubiegłych latach sektor finansowy był liderem różnorodności ze względu na płeć na koniec 2024 r., z 25,5-procentowym udziałem kobiet we władzach. Finanse zanotowały niestety spadek rdr o 1,8 pp., zmniejszając tym samym dystans do kolejnych sektorów (nieruchomości 21,2% oraz detal 21,1%), które w trakcie 2024 r. zwiększyły udział pań w organach o 1,7-1,8 pp.

Najgorsza sytuacja pod względem różnorodności w władzach ze względu na płeć była w sektorze rolno-spożywczym (10,3%), przemysłowym (13,7%) oraz medycznym (16,7%). Najbliżej średniej znalazły się z kolei TMT oraz energetyka i surowce, w których łącznie pań w zarządach i radach nadzorczych było odpowiednio 18,4% oraz 17,1%.

POGORSZENIE POZIOMU ROŻNORODNOŚCI PŁCI WŚRÓD BLUE CHIPÓW I GIEŁDOWYCH „MALUCHÓW”. ISTOTNA POPRAWA WŚRÓD „ŚREDNIAKÓW”

W ramach WIG140 w minionym roku mieliśmy do czynienia z różnicą między spółkami z mWIG40, a tymi z WIG20 oraz sWIG80. W przypadku WIG20 rok 2024 przyniósł pogorszenie różnorodności płci we władzach, ze spadkiem udziału kobiet o 0,8 pp. rdr do 22,1%. W przypadku giełdowych „maluchów” (sWIG80) udział kobiet we władzach spadł o 0,9 pp. rdr, do 14,9%. W przypadku największych spółek, czyli WIG20, udział kobiet spadł zarówno w zarządach (-0,9 pp. rdr do 15,3%) jak i radach nadzorczych (-1,3 pp. rdr do 27,0%). Lekko odmienne tendencje były widoczne w sWIG80. We władzach spółek z tego indeksu udział pań w zarządach nieznacznie wzrósł (+0,2 pp. rdr do poziomu 11,8%), natomiast istotnie pogorszył się na poziomie rad nadzorczych (-1,5 pp. rdr do poziomu 16,7%).

Giełdowe „średniaki”, czyli spółki z indeksu mWIG40, zanotowały z kolei pozytywny trend. Udział kobiet w ich władzach wzrósł względem poprzedniego roku o solidne 3,5 pp. rdr do 22,0%, tym samym praktycznie zrównując ten wskaźnik z poziomem dla WIG20. Na koniec 2020 r. różnica miedzy tymi indeksami wynosiła aż 6 pp., co pokazuje, że w porównaniu do blue chipówspółki średniej wielkości w ostatnich latach zanotowały relatywnie szybki progres. Jeśli przedstawiciele mWIG40 utrzymaliby tempo poprawy wskaźnika w kolejnych latach, to 30-procentowy próg udziału kobiet we władzach zostałby przekroczony w 2027 r. Udział pań w zarządach spółek z mWIG40 wyniósł 16,8% a w radach nadzorczych 25,5%.

Dane za miniony rok zaskakują i martwią. Udział kobiet we władzach spółek WIG140 wzrósł niezauważalnie, pomimo coraz wyższej wiedzy spółek i ich akcjonariuszy o wymogach zbliżającej się implementacji tzw. Dyrektywy Women on Boards. Największe rozczarowanie to w mojej opinii blue chipy. W spółkach WIG20, które powinny mieć największą świadomość korzyści płynących z różnorodności, w największym stopniu będą podlegały nowej legislacji i mogą pozwolić sobie na rozbudowane narzędzia do pracy nad diversity, sytuacja w ciągu roku uległa pogorszeniu. I to mimo tego, że w wielu z nich w 2024 r. miały miejsce zmiany w organach, które mogły zostać wykorzystane do poprawy sytuacji.

MAŁO PREZESEK, CORAZ MNIEJ PRZEWODNICZĄCYCH RAD NADZORCZYCH

Podobnie jak w latach ubiegłych, kobiety częściej można było spotkać w radach nadzorczych niż w zarządach. Na koniec 2024 r. udział kobiet w organach nadzorczych badanych spółek minimalnie wzrósł i wyniósł 21,1% (+0,5 pp. rdr), natomiast w zarządach istotnie się nie zmienił (14,1% na koniec 2024 r. w porównaniu do 13,9% na koniec 2023 r.).

Na koniec 2024 r. w badanej grupie jedynie 6 firm, czyli tylko 4,3% ogółu, miało kobietę na stanowisku prezeski zarządu. Liczba ta nie zmieniła się w trakcie poprzedniego roku i pozostaje na dramatycznie niskim poziomie. Nieco więcej pań, choć wciąż niewiele, na koniec minionego roku kierowało pracami rad nadzorczych – 16, czyli 11,4% wszystkich badanych spółek. Rozczarowujący jest natomiast trend w przypadku tego wskaźnika – wynik jest bowiem najgorszy od 5 lat (czyli w całym okresie, w którym 30% Club Poland zbiera dane). Dla porównania w 2020 r., pierwszym roku badania wśród spółek z WIG140, przewodniczących rad nadzorczych było 21.

NIELICZNE SPÓŁKI SPEŁNIAJĄ KRYTERIA PROJEKTU USTAWY IMPLEMENTUJĄCEJ DYREKTYWĘ KOBIETY WE WŁADZACH

Zgodnie z listopadową wersją projektu nowelizacji Ustawy o ofercie publicznej (…), która ma wdrożyć Dyrektywę Kobiety we władzach do krajowego ustawodawstwa, równowaga płci w organach spółki jest zapewniona wtedy, gdy łączna liczba stanowisk w organach spółki zajmowanych przez osoby należące do niedostatecznie reprezentowanej płci jest nie mniejsza niż liczba najbardziej zbliżona do 33% liczby wszystkich stanowisk w organach spółki; oraz osoby należące do niedostatecznie reprezentowanej płci zajmują stanowiska w każdym z organów spółki, proporcjonalnie do liczby stanowisk w danym organie.

Wśród spółek WIG140 tylko 28 firm posiadało przynajmniej 33% udział kobiet w zarządach, a 42 spółki posiadały taki udział w odniesieniu do rady nadzorczej. Kryterium 33% w obu organach jednocześnie spełniało tylko 11 spółek. Natomiast 23 spółki posiadały udział niedoreprezentowanej płci na poziomie 33% w zarządach i radach nadzorczych łącznie.

Działanie na rzecz różnorodności we władzach spółek chyba nigdy nie było tak ważne jak teraz. Niesprzyjające okoliczności polityczne na świecie, wycofywanie się wielu zagranicznych firm z działań DEIB oraz przedłużające się wdrożenie Dyrektywy Women on Boards w Polsce przysłaniają podstawową kwestię, czyli korzyści płynące z różnorodności. 18,4% udziału kobiet we władzach spółek z WIG140 to zdecydowanie poniżej 30% wynikającego z tzw. teorii masy krytycznej i celów 30% Club Poland. Globalne sukcesy 30% Club pokazują siłę stawiania osobom na najwyższych szczeblach mierzalnych i ambitnych celów z zakresu różnorodności. Nie ma na co czekać. Zmiana nie dokona się sama.

NIEWIELU KOBIET POTRZEBA ABY POPRAWIĆ SYTUACJĘ

Wydźwięk danych jest jednoznacznie negatywny, co jest rozczarowujące, biorąc pod uwagę udowodnione korzyści biznesowe płynące z różnorodności oraz to, że wielkimi krokami zbliża się wdrożenie tzw. unijnej Dyrektywy Kobiety we władzach. Co ciekawe, aby poprawić sytuację i zwiększyć udział kobiet w giełdowych spółkach, nie potrzeba ogromnej liczby pań. Zakładając, że wszystkie 140 spółek podlegałoby pod nowelizację Ustawy o ofercie (…) na koniec 2024 r. brakowałoby zaledwie 116 kobiet w zarządach i 131 w radach nadzorczych by w spółkach z WIG140 było ich 33%. Zakładając konieczność posiadania 33% udziału niedoreprezentowanej płci w każdym z organów, brakuje więc 247 pań. Jeśli wymóg prawny dotyczyłyby 33% udziału niedoreprezentowanej płci w zarządach i radach nadzorczych łącznie, brakowałoby 234 pań. Kompetentnych, świetnie wykształconych i zmotywowanych kobiet nie brakuje, a pozytywna zmiana wydaje się być w zasięgu ręki.

30% CLUB POLAND CIĄGLE ROŚNIE

Badania zostały przeprowadzone przez 30% Club Poland, kampanię społeczną na rzecz zwiększania różnorodności we władzach spółek, angażującą do działania osoby na najwyższych stanowiskach kierowniczych. Lista członków 30% Club Poland stale się powiększa. W ostatnim czasie do Klubu dołączyli m.in. Beata Orłowska, Prezes Zarządu Oerlemans Foods w Polsce oraz Piotr Krupa, Prezes Zarządu Kruk S.A. Łącznie 30% Club Poland ma obecnie 31 członków i członkiń oraz 28 instytucji wspierających. Lista tych ostatnich powiększyła się ostatnio m.in. o Akademię Leona Koźmińskiego.

Board Resume Masterclass: Empowering Future Board Leaders

The Board Resume Masterclass proved once again to be a transformative experience for participants, focusing on building powerful and persuasive Board Resumes.

The Board Resume Masterclass is a key flagship event under the 30% Club Malaysia. Since its inception four years ago, the Board Resume Masterclass has guided nearly 100 mentees, helping them refine their board resumes and enhance discussions with their mentors.

The Masterclass has become a cornerstone in the development of board-level leadership. It offered valuable tips and guidance on board resume writing, along with a workshop where participants had the opportunity to work on sample resumes – the crux of the session.

This session saw 16 participants from the first batch of Cohort 10 in the Board Mentoring Scheme attended the session, which was facilitated by Raj Kumar Paramanathan, Co-Lead of the 30% Club Malaysia Enable Talent Pillar and Partner/Managing Director of CnetG Asia.

The session began with a welcome address from our corporate advocate, Peter Murray, Country Head of AWS Malaysia, who reaffirmed AWS’s dedication to supporting and strengthening DEI initiatives as a core commitment.

Norlela Baharudin, Co-Lead of the Enable Board Mentoring Scheme, in her opening speech, emphasised the importance of a board resume as a personal brand and how it presents them to prospective board nomination chairs and committees.

She highlighted that the board resume differs significantly from an executive resume and that this Masterclass offers invaluable guidance on reflecting and crafting your personal brand.

According to Raj Kumar, a well-crafted board resume is more than just a document – it is a strategic tool that shapes your leadership journey. The process of creating it offers a valuable opportunity to reflect on your unique strengths and present them with clear intent.

When asked on some of the AHA moments in the session.

Datin Kalavalli Sethu, founder and MD of Compass Insights Sdn Bhd shared that “assessing one’s own value contribution in the process of resume writing is a continuous process. It highlights the importance of self-reflection to create a resume that focuses on one’s unique strengths and contributions”

“I value the logical step-by-step process that Raj Kumar has taken us through in building my thought flow,” said Dr. Becky Low, G100: Mission Million’s Malaysia Country Chair – Humanity, Technology & Innovation. She explained it has helped her to structure her ideas effectively and build a strong and cohesive flow of thoughts, making the CV-writing process much more manageable and purposeful.

Meanwhile, Woan Chyi of AWS Malaysia agreed that the guidance provided by Raj Kumar transformed CV writing from a daunting task into a simpler and more organised process.

The event was generously hosted at the AWS Malaysia office in Kuala Lumpur. The next session for the second batch of Cohort 10 mentees is scheduled for April 2025, once again at the AWS Malaysia office.

Power in Partnership: Driving Corporate Diversity and Women’s Leadership in Malaysia

When three powerhouse organisations unite, change isn’t just possible—it’s inevitable.

Today, we are thrilled to share breaking news of a partnership between the 30% Club Malaysia, Penang Women’s Development Corporation(PWDC), and the National Association of Women Entrepreneurs of Malaysia (NAWEM). The partnership was formalised today by Yang Berbahagia Dato’ Bee Leng Ong, Chief Executive Officer (CEO) of PWDC; Sarojini Ruth, President of NAWEM; and Nurul Ain Abdul Latif, Chair of the 30% Club Malaysia.

Our mission? To create a more inclusive corporate landscape in Penang and beyond. We’re accelerating. Mentorship. Networking. Advocacy. Skill-building.

As of October 2024, women now hold 32.2% of board seats in top 100 public-listed companies in Malaysia – but we’re not stopping here! This partnership represents more than an agreement. It’s a commitment to amplify women’s voices in leadership, drive innovation through diversity and create tangible opportunities for women entrepreneurs.

Together, we’re proving that diversity isn’t just a goal – it’s a powerful and imperative strategy for business success. These aren’t just words. It is our blueprint for a more equitable corporate future.

„Wsparcie rozwoju zawodowego kobiet” przy Ministerstwie Aktywów Państwowych

5 grudnia 2024 roku zakończył się 5 miesięczny projekt „Wsparcie rozwoju zawodowego kobiet” przy Ministerstwie Aktywów Państwowych, który powstał z inicjatywy Ministra Aktywów Państwowych, Jakuba Jaworowskiego.

Bardzo się cieszymy, że 30% Club Poland wraz z wieloma instytucjami działającymi na rzecz różnorodności i równych szans był włączony w te prace. Wynikiem wielogodzinnych spotkań i dyskusji były przekazane Ministrowi rekomendacje. Kompleksowy dokument dotyczy zarówno implementacji unijnej dyrektywy Women on Boards, jak i długofalowego wsparcia rozwoju zawodowego kobiet na różnych szczeblach kariery w spółkach z udziałem Skarbu Państwa. Mamy nadzieję, że posłuży on do dalszych działań resortu aktywów państwowych w tym obszarze.

Dziękujemy Milenie Olszewskiej-Miszuris, Mirosławowi Kachniewskiemu, Justynie Przybył, Joannie Zakrzewskiej, Jakubowi Wojnarowskiemu i Andrzejowi Antonowi za pracę w obu strumieniach projektu i reprezentowanie 30% Club Poland. Cieszymy się, że Ambasadorki kampanii Agnieszka Kulikowska i Katarzyna Piasecki także przyczyniły się do sukcesu projektu.

Liczymy na kolejne działania wraz z Ministerstwem Aktywów Państwowych na rzecz #DEI, w których z chęcią weźmiemy udział.

Grudniowy CEO Breakfast

Grudzień to czas podsumowań, nie mogło więc ich zabraknąć także w 30% Club Poland.

W 2024 roku 30% Club Poland zainicjował cykl spotkań Członkiń i Członków w kameralnej formule CEO Breakfast. 3 grudnia odbyło się trzecie wydarzenie, za które składamy ogromne podziękowania Gospodarzowi Andrzejowi Pośniakowi oraz Zespołowi CMS Poland, szczególnie wspierającej nas od lat Ewy Cacaj. Spotkanie było poświęcone bardzo aktualnemu tematowi jakim jest sztuczna inteligencja, a prezentacja na temat AI i programowania zrobiła ogromne wrażenie na uczestnikach i uczestniczkach. Dyskusja była pełna inspiracji, ogniskując się wokół tematu przywództwa, etyki i różnorodności w erze sztucznej inteligencji.

Naszym planem na Nowy Rok jest kontynuacja tych niezwykłych spotkań! Z każdym śniadaniem cieszą się one coraz większym zainteresowaniem – to motywuje nas do dalszego działania.

Kolejne spotkanie już w Nowym Roku.

Evolving Role of Board Directors: Path to the Future

At the Board Awareness Program: Woman in STEM: Power Up! event organised by the 30% Club Malaysia, Tenaga Nasional Berhad and MyWiE. Three women leaders at their respective industries shared their thoughts and journey on board.

The panellists were Datuk Ir. Rosaline Ganendra, Jenifer Thien, and Dato’ Roslina Zainal and the event was moderated by our own Geetha Kandiah.

The panelists agreed that the role of board directors has evolved significantly.

Once upon a time directors were deeply involved in operations, today’s non-executive directors (NEDs) focus more on strategy and act as advisors to CEOs and management teams. Among the key takeaways were:

𝐂𝐨𝐫𝐩𝐨𝐫𝐚𝐭𝐞 𝐆𝐨𝐯𝐞𝐫𝐧𝐚𝐧𝐜𝐞 𝐀𝐜𝐫𝐨𝐬𝐬 𝐁𝐨𝐫𝐝𝐞𝐫𝐬: Serving on multiple boards – locally and internationally – provides invaluable exposure to different governance standards and enhances strategic thinking.

𝐄𝐯𝐨𝐥𝐯𝐢𝐧𝐠 𝐄𝐱𝐩𝐞𝐜𝐭𝐚𝐭𝐢𝐨𝐧𝐬: While directors once handled operational details, today they must focus on strategic decision-making and ensure that management executes effectively.

𝐓𝐡𝐞 𝐑𝐨𝐥𝐞 𝐨𝐟 𝐄𝐒𝐆: As Environmental, Social, and Governance (ESG) becomes mandatory, boards are increasingly seeking technical expertise in sustainability. STEM professionals, engineers, and technocrats are key in addressing these issues.

𝐍𝐚𝐯𝐢𝐠𝐚𝐭𝐢𝐧𝐠 𝐒𝐭𝐞𝐫𝐞𝐨𝐭𝐲𝐩𝐞𝐬: Women on boards often face the stereotype of being too operational or detail-oriented. Embracing self-awareness, trusting others, and adapting to a strategic perspective are essential for overcoming this.

Also, to succeed as a board member, directors must:

1) Understand financial reports and have basic legal knowledge.

2) Have a deep understanding of technical details to inform decision-making.

3) Possess strong personal branding and business acumen, with the ability to translate technical expertise into strategic outcomes.

As emphasised by the panelists, mentoring plays a crucial role in leadership development. When seeking a mentor, it’s vital to ask the right questions, focus on how to present issues, and work collaboratively.

Networking and fostering male allyship also help support women leaders aspiring for board positions.

In conclusion, achieving greater gender diversity in the boardroom requires collective effort. Programmes that prepare women to be board-ready, challenge biases, and value diverse perspectives are critical in building a sustainable pipeline of talent.

Let’s continue to empower future-ready leaders who will drive innovation, inclusivity, and excellence at every level.