A year ago, commercial banker Jessica Jones underwent a life-saving operation to remove a brain tumour that left her unable to walk unassisted.

Since then, not only has the 38-year-old mum of three from Swansea returned to the job that she loves but she’s also embarking upon a journey of personal development by being mentored on the 30% Club cross-company mentoring programme Mission INCLUDE.

It was important to Jessica to explain this life-changing experience to her mentor at their first meeting in November. Her diagnosis 18 months earlier changed her outlook on life and her career and will be a big part of her mentoring journey.

At its core, Mission INCLUDE is a structured cross-company mentoring programme that expertly pairs senior business leaders with mentors outside of their industry to challenge and help them progress.

Jessica is a relationship director at NatWest with responsibility for financing SMEs with turnovers of up to £50 million. She has been paired with mentor Laura Pingree, a partner at accountancy firm BDO LLP, who specialises in energy and mining.

During their first meeting, Jessica revealed how the excitement of receiving a promotion in March 2020 was overshadowed, three months later, by the devastating news that she would require life-saving surgery.

“I didn’t want sympathy, but I wanted her to know the journey I’d been on and why I was so determined to get the most out of this experience,” she says.

Jessica explained to Laura that after suffering hearing loss, headaches and tinnitus since 2019, she saw her GP in June 2020, who prescribed migraine tablets. But when the symptoms didn’t improve after a couple of days, she was referred to hospital for a CT scan.

While waiting for that appointment, her blood pressure became abnormally high, so she attended Prince Phillip hospital in her hometown of Llanelli, Carmarthenshire. After two days of tests – and while sat alone due to Covid restrictions – Jessica was given the devastating news that she had an acoustic neuroma causing pressure on her brain stem.

“I was in total shock. Hearing those words, ‘you’ve got a brain tumour’ was terrifying. I was absolutely petrified and burst into tears,” says Jessica.

Backlogs caused by the pandemic meant she had to wait until January 2021 for surgery.

During a gruelling 13-hour operation, which involved removing a section of skull from behind Jessica’s ear, surgeons successfully removed most of the tumour. They advised to leave a small part of the tumour which had grown around the facial nerve, so not to cause facial palsy. The procedure has left her with single sided deafness and a CROS hearing aid.

She was kept in hospital for two weeks. Covid restrictions meant that Jessica’s husband Mark and their daughters Ella who is eight, and five-year-old twins Emily and Lily, couldn’t visit her.

“I was unable to stand the first few days without vomiting due to the vertigo, and each day challenged myself a little more. Thanks to the support of the team there, I finally left the hospital trundling along on a Zimmer frame at the age of 37,” she says. “When I was home, I paid for weekly sessions with a neuro-physio who helped me build the confidence and strength to walk without the frame.”

Her diagnosis left her fatigued and sometimes unable to walk more than 2,000 steps a day, but in September 2021, Jessica was keen to return to the job that she loves.

“Natwest has fully supported me since the moment I was diagnosed and on the path towards rehabilitation,” says Jessica. “We spoke about both my personal and career development and I explained that I thought that being mentored by someone outside of banking would help develop me as an individual. They recognised what I had been through – and the journey that still lies ahead – and I’m grateful they gave me special approval to take part in Mission INCLUDE.

“In the 14 years I’ve worked for NatWest, I’d previously been on excellent courses that were bank focused and I have always been very passionate and committed in taking responsibility for my career progression. I knew that I would benefit from having an outside mentor challenge me, hold me accountable and offer external perspective on my development.”

Jessica admits she was initially surprised by who she was paired with.

“When I first read Laura’s profile, I was unsure as to why we’d been put together as our experience looks so different on paper. But I soon realised we are so well matched. Our personalities are very, very different but whatever algorithms Moving Ahead use to match people, it definitely works!

“We are very open with each other about our lives and our experiences. You need that openness, otherwise the mentoring would be very scripted.”

At their most recent meeting in January, Laura challenged Jessica to apply to sit on a non-executive board during the nine-month programme – something that would help give her exposure to other business issues that could be of use to her in NatWest.

In preparation, she’s also been tasked with gathering 360° feedback from colleagues to see if the areas that Jessica thinks that she needs to develop align with those they suggest.

“I questioned who would want me on their board, but by sharing her own experiences, Laura was able to reassure me that I have transferable skills and that businesses in sectors outside of banking – and outside of my comfort zone – would welcome,” she says. “And I now realise the experience would greatly aid me in my development within NatWest.”

Aside from the one-to-one mentoring, Mission INCLUDE offers other benefits.

“The programme includes regular Zoom events with participants from around the world, masterclasses to get the best out your development, networking sessions with other mentees, and the opportunity to hear from fantastic, thought-provoking expert speakers,” she says.

A recent talk by coach Holiday Phillips on pushing yourself outside of your comfort zone resonated with her.

“On Christmas Eve, I received the news that the remainder of my tumour is stable and I’ll have yearly scans to monitor what is left of it,” she says. “Having the tumour has taught me is life is too short to be taken for granted and to keep pushing yourself, developing and reflecting. Sometimes that means doing things that you’re a little uncomfortable with, but you may never get the opportunity to do again if you don’t do them now. I want to push myself and do things that perhaps make me feel a little bit uncomfortable.”

Jessica can already see the benefits that the Mission INCLUDE programme will bring to her and NatWest.

“I am already learning lots that I can apply to my current role and future development. Having a mentor share their expertise and encouragement will also help equip me with new skills that I can bring to the bank to assist others,” she says.

And it’s not only at the bank that that Jessica wants to help others. Last month, she embarked on an ambitious 10,000 Steps a Day challenge to fundraise and raise awareness for Brain Tumour Research to help find a cure for the devastating disease as a way of thanking all those who helped her. She raised more than £2,500. If you would like to donate, click here for more information.

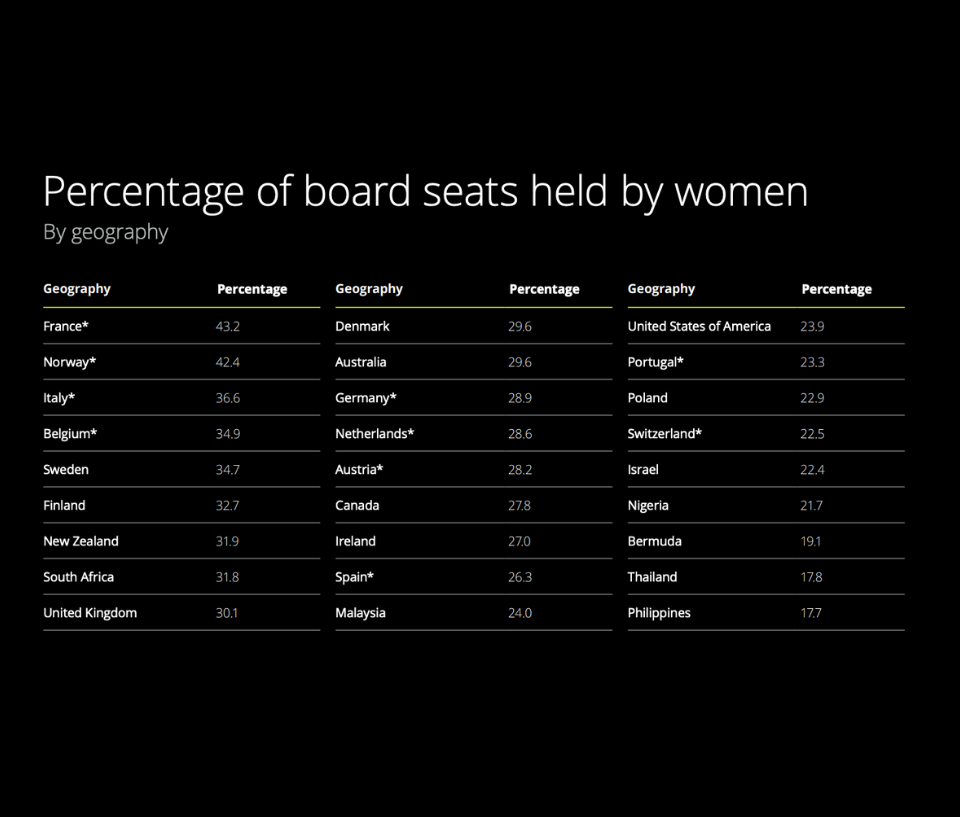

Where we are

The 30% Club has come a long way from when it was set up in the UK in 2010.We now span six continents and more than 20 countries. We’re actively expanding into more G20 countries