The 30% Club is delighted to announce the appointment of Hanneke Smits, CEO of BNY Mellon Investment Management, as its fourth Global Chair, succeeding Ann Cairns.

Hanneke has been a long-time champion of improving gender diversity in the workplace. In 2015, she co-founded Level 20, a not-for-profit organisation established to inspire women to succeed in the private equity industry.

Hanneke also serves as Chair of Impetus, a venture philanthropy organisation that backs charities to transform the lives of disadvantaged young people.

At BNY Mellon, Hanneke is the Executive Sponsor of PRISM, the company’s LGBTQ+ employee group, and as CEO of BNY Mellon Investment Management since October 2020, one of the largest asset managers in the world with $1.8 trillion in assets under management.

She has championed numerous initiatives such as Newton’s work with the Diversity Project to ensure that returning female portfolio managers were able to maintain their investment track record, and BNY Mellon’s partnership with Inspiring Girls through The Pathway to Inclusive Investment research in 2022, and being an early supporter of the UK’s #10000BlackInterns programme.

Hanneke succeeds Ann Cairns as global chair of the 30% Club.

Ann, who retired as Executive Vice Chair of Mastercard at the end of 2022, joined the campaign in 2019 as Co-Chair, working with the late Brenda Trenowden before becoming sole global Chair in 2020.

Hanneke Smits, CEO of BNY Mellon Investment Management, said: “It is an honour to succeed Ann Cairns as Global Chair of the 30% Club and to continue its mission of increasing the number of women at board and senior management levels.

“The role of the 30% Club is as vital now as it was at launch in 2010. Even today, the baseline target of reaching 30% women – either at board or senior management level – remains a stretch for many organisations throughout the world. Reaching the campaign’s ultimate goal of gender parity will take significant effort and investment.

“I look forward to continuing to grow the 30% Club internationally and tackle a wider range of diversity challenges, inside and outside the boardroom.”

Under the leadership of Ann, the 30% Club formed new chapters in Mexico, Colombia and Chile and welcomed Poland, Ecuador and an investor group in France to the campaign.

Her involvement with UN Women’s Outstanding Women’s Leaders Group saw the 30% Club, Melinda French-Gates and the UN Foundation convene what is presumed to be the world’s biggest meeting of CEOs and company chairs to discuss gender equality in May 2021.

Cairns also broadened the UK chapter’s target to focus on racial equality, which included the launch of the Mission INCLUDE strand of the 30% Club’s world-leading and cross-company mentoring programme enabling individuals from all underrepresented groups to participate.

She also launched the Leaders for Race Equity CEO development programme last year in partnership with Change the Race Ratio and Moving Ahead.

Ann Cairns, outgoing Global Chair of the 30% Club, said: “On behalf of the members of the 30% Club, we are proud to welcome Hanneke as our new Global Chair. It will be invaluable to have a respected leader of Hanneke’s experience and calibre join the global campaign at a time when many companies are still struggling to achieve diversity at board and executive levels.

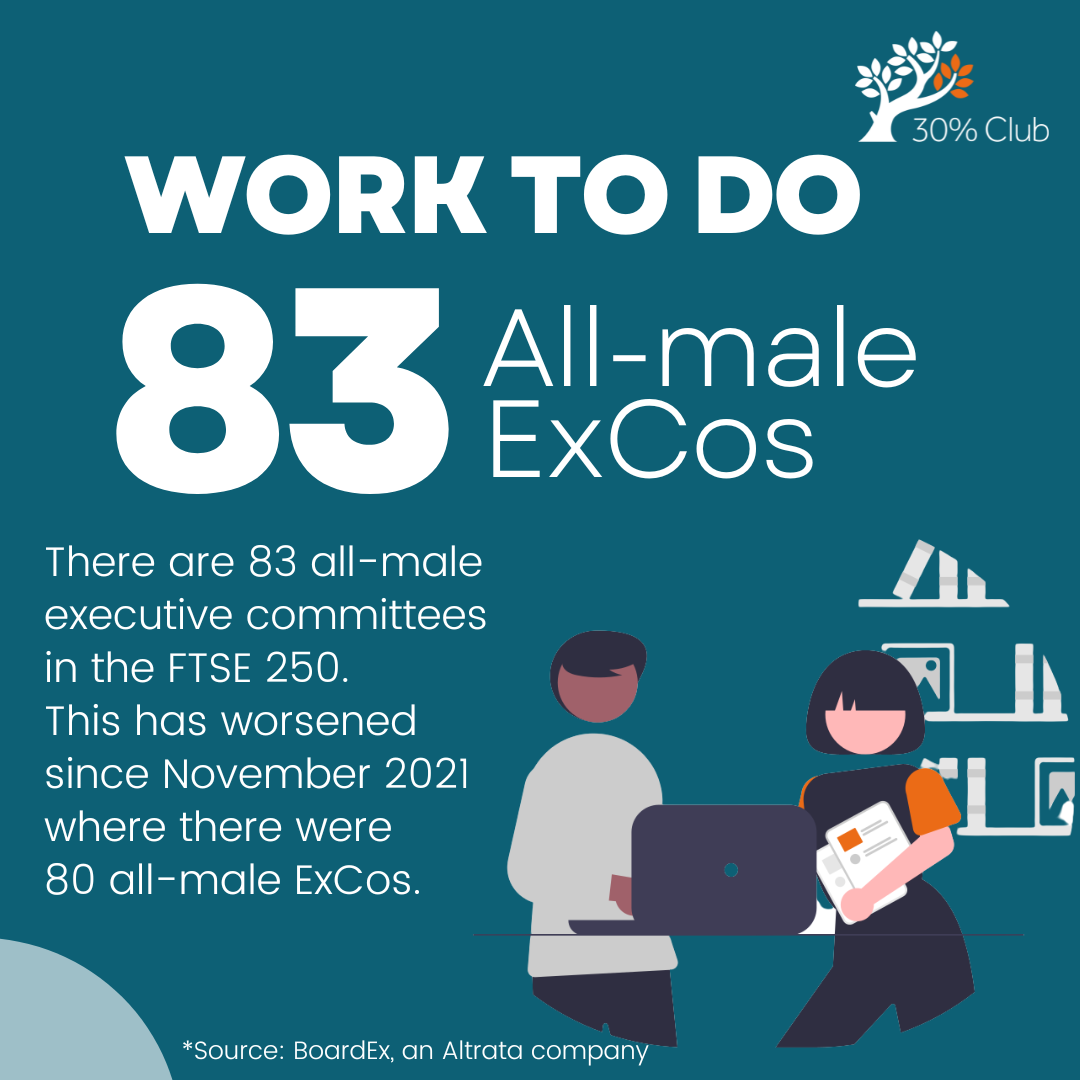

“In the UK, for instance, we may have reached 40% women on the boards of the FTSE 100, but the majority remain in non-executive roles; there are just 25% women at executive committee level and just eight female CEOs. Women of colour remain under-represented at every managerial and leadership level. We must continue to keep diversity and inclusion high on the agenda.”

This is the second time BNY Mellon Investment Management has taken a leadership role within the 30% Club. The campaign was launched in 2010 by Dame Helena Morrissey, who was the then CEO of Newton Investment Management, one of BNY Mellon Investment Management’s investment firms.

Newton and BNY Mellon Investment Management were early supporters of the campaign’s goals and helped encourage many chairs of Britain’s biggest companies to commit to the initial target of 30% women on their boards. This target was reached across the FTSE 100 in September 2019 and there are now 40% women on boards.

This transparency allows firms to learn together ‘what works’ for the fair inclusion of Black women in finance, professional services and big technology. Given that the pay gaps experienced by Black women are the largest in the sectors studied, making Black women the benchmark for real change within organisations is appropriate.

Training, recruitment, operations, promotions, procurement, strategies, and policies should be evidently inclusive of Black women. The call for greater transparency through reporting, audits and monitoring of the progress of Black women will help ensure firms are on track.

The 30% Club would like to thank UK steering committee member Karin Barnick, a partner at executive search and leadership advisory firm Korn Ferry in London, who led the search for the new global chair on a pro bono basis.

Where we are

The 30% Club has come a long way from when it was set up in the UK in 2010.We now span six continents and more than 20 countries. We’re actively expanding into more G20 countries