The Women in Finance Climate Action Group has developed a framework to help financial institutions support women in the net zero transition and limit the negative impact of climate change on women.

The 30% Club is delighted to support the rollout of this first-of-its-kind framework specifically for private investors and the key role they play in financing net zero.

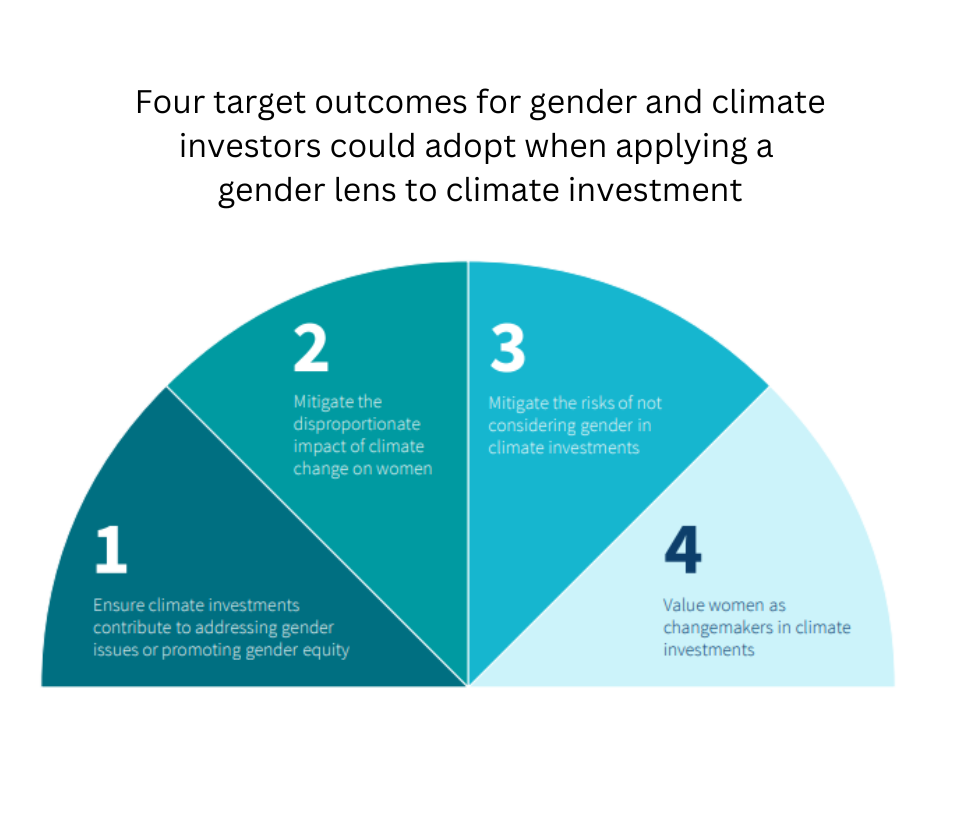

Integrating a gender lens into climate investments is important to value women as key stakeholders in solutions, to ensure not only a better path, a more ‘Just Transition’, but also a shorter one, unleashing the potential of women as changemakers, in finance and in who and what is being financed.

Women remain under-represented in climate finance

The Women in Finance Climate Group argues that whilst climate change disproportionately impacts women, women remain seriously under-represented in climate policy, climate decision-making and climate finance.

The Action Framework, created in collaboration with the Oliver Wyman Forum and 2X Global, is available to download here.

The Women in Finance Climate Action Group comprises women leaders from business, the public sector and civil society and includes Tanya Steele, CEO of WWF-UK and Sarah Breeden, Executive Director at the Bank of England.

Amanda Blanc, Aviva’s Group CEO, said: “Private capital is key to mobilising the trillions of dollars required over the next three decades to limit warming to 1.5 degrees. And yet the global private finance sector does not currently have the tools or incentives in place to evaluate and improve the impact of climate finance on gender equality.

“We need more data to measure the impact of specific climate investments or project financing on women and girls. We hope this Framework will give financial institutions what they need to begin to measure and deliver greater gender equality when taking action on net zero.”

Rupal Kantaria, Partner, Oliver Wyman Forum and head of climate for the 30% Club, added: “This first-of-its-kind Action Framework for investors embeds gender considerations into climate investment decisions. Both are critical for financing a faster and more just climate transition.”

Where we are

The 30% Club has come a long way from when it was set up in the UK in 2010.We now span six continents and more than 20 countries. We’re actively expanding into more G20 countries